Section 1: Performance Year to Date

The data for the first quarter of 2025 is in—and yes, as usual, I had a blast digging through the numbers. As always, the truth is in the trends, and this time around, there's a lot to discuss.

Let’s get into it.

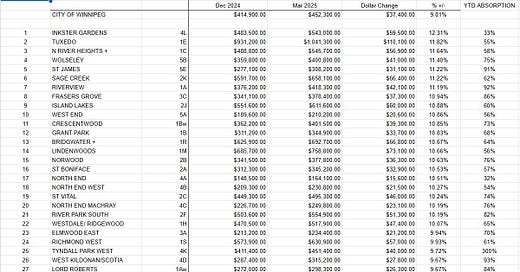

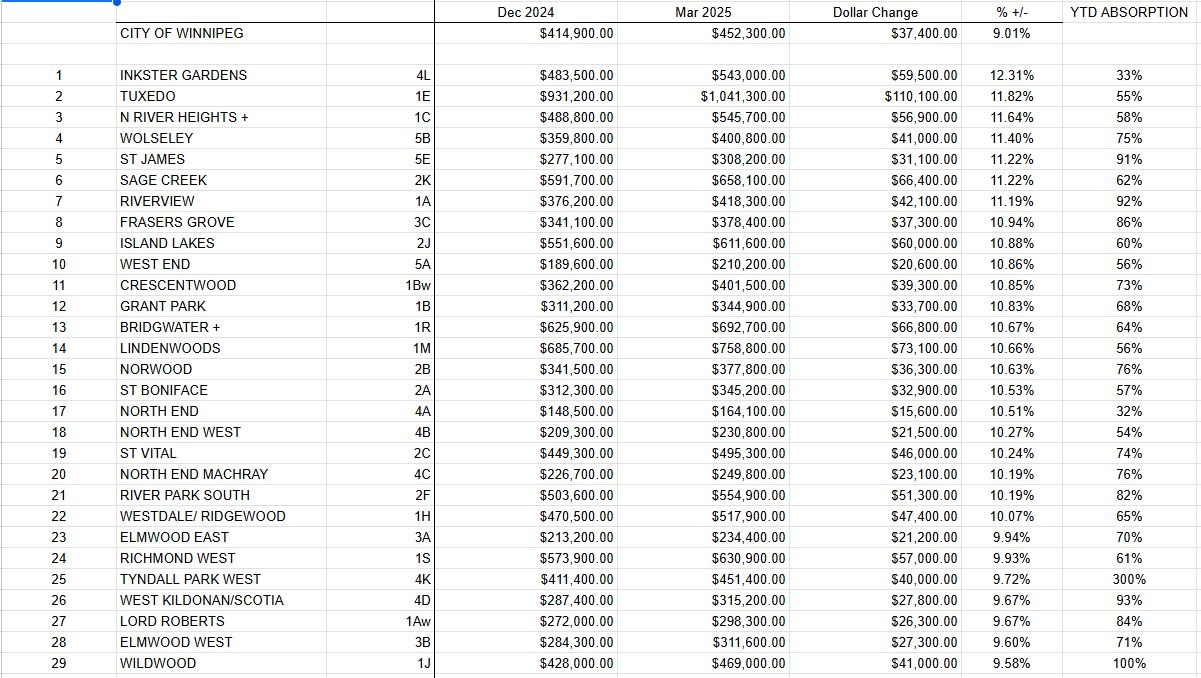

Most of the City is Up More Than You Think

Out of Winnipeg’s 61 MLS areas, 41 are performing at or above the citywide benchmark increase of 9.01%. In plain English: the majority of the city is already up double digits. That’s a powerful signal, as it indicates the genuine possibility of only a small number of areas holding the overall benchmark price lower than it could have been.

This would explain why, anecdotally, certain areas have been “150k+ over asking” bidding war prone, while others have appeared active, but still softer.

2024’s Darlings? Not So Much in 2025

Some of the biggest winners from 2024 have been slow out of the gate in 2025. High-profile areas like 3G, 3P, 1P, 4G, and 4F—all of which saw explosive pricing growth and high absorption numbers until recently—are now languishing near the bottom of the list.

To me, that screams saturation. These neighborhoods likely hit their short-term ceiling, and buyers have started shifting their attention—and therefore their money—to more affordable alternatives. And who could blame them?

The Sub-$300K Club is Almost Gone

Here’s a stat that I’ve been brining up a lot lately: only six MLS areas in Winnipeg are still under a $300,000 benchmark price—that’s 4A, 4B, 4C, 5A, 5C, and 5D.

For the first time in our market’s history, it’s no longer a given that you can find something in a generally regarded as “safe” area under $300K in Winnipeg. Just for perspective, qualifying for a $300K purchase with 5% down and no co-signer currently requires $80,000/year in income and zero debt. That’s a major affordability threshold, and it’s only going to get tougher for single income families to purchase residential property if this continues.

As I’ve said before, pricing always starts at the bottom and works its way up. These shifts suggest a new bar has been set for what entry-level homeownership looks like in Winnipeg, and as that barrier to entry rises, those dollars will work their way up through the pricing categories.

High-End Areas Are Making a Comeback

Unlike last year, Winnipeg’s upper-tier neighborhoods aren’t sitting this one out either. Areas like 1E (Tuxedo), 1M (Lindenwoods), 2K (Sage Creek), 2J (Island Lakes), 2F (River Park South), 1R (Bridgwater), and 1S (Richmond West) have all posted 10%+ gains so far this year.

Let’s not gloss over how significant that is. These are not starter-home neighborhoods—we’re talking $550K+ benchmarks, with most well beyond that! A 10% gain in these markets might mean six-figure growth in real dollars for some owners. That’s serious movement, and it’s one of the more important trends to watch heading into the summer.

The Underdogs Are Barking Loud

Flip the map, and you’ll find Winnipeg’s historically lowest-priced areas putting up some of the most impressive numbers of Q1.

5A cracked the top 10 in gains, while 4A, 4B, and 4C also posted big wins. These aren’t typically the neighborhoods that make headlines, but when even your second- and third-choice areas become unaffordable, buyers need to start getting creative—and opportunistic.

What we’re seeing is the ripple effect of affordability. When the rest of the market climbs out of reach, overlooked pockets start getting noticed. This trend of lower-priced areas overperforming could stick around, especially if citywide benchmarks continue climbing.

The 3s Have Hit a Ceiling

It’s looking like areas beginning with a “3”—which make up much of Winnipeg East of the Red River and north of Dugald Rd—are finally stalling out.

After going borderline parabolic in 2023 and 2024 with near-perfect absorption for almost 24 months straight, many of these neighborhoods are losing steam. That frantic buyer activity and price escalation seems to have exhausted itself—for now.

So, where does the action shift next? If I had to place a bet, I’d say it’s probably going to start with a “2.”

Overall Thoughts on the YTD data:

Q1 has made one thing clear: Winnipeg is in the middle of a major financialization of our real estate market, and it is slowly transforming our city. The pricing ladder keeps climbing, the bottom rung is disappearing, and old assumptions about where the deals are might no longer apply.

Whether you're buying, selling, or just watching from the sidelines, this is a market that’s rewarding those who move early and think strategically.

If you’re trying to figure out your next move, let’s talk. No pressure—just real strategy.

204-955-0173

keenanbrownrealtor@gmail.com

Section 2: Performance since the 2022 High

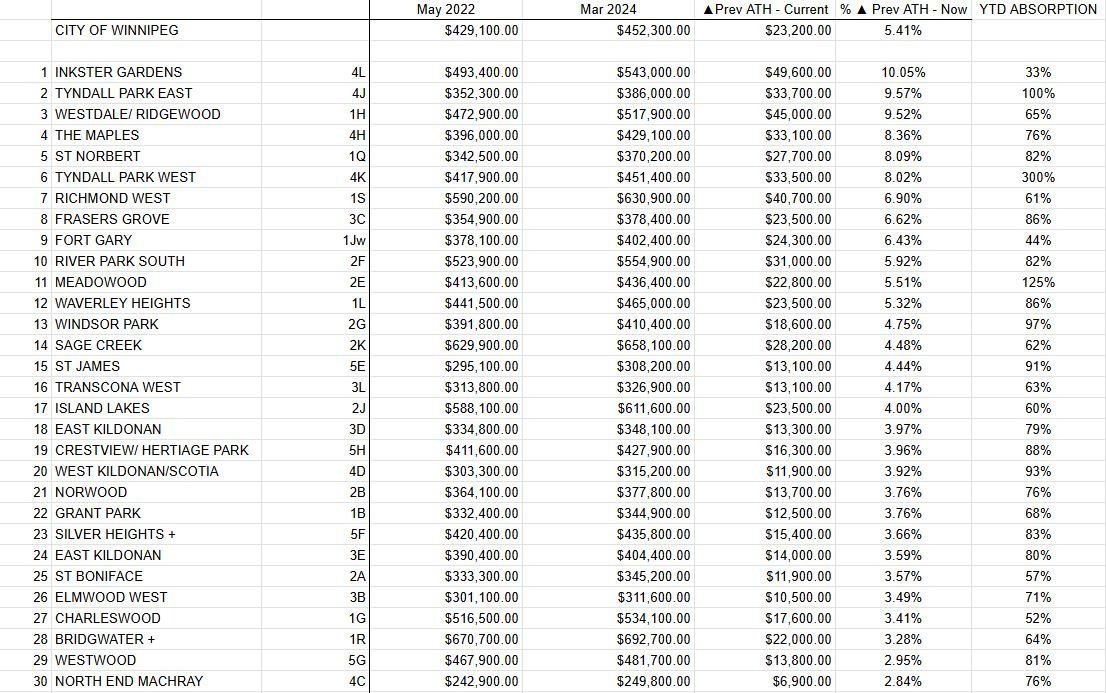

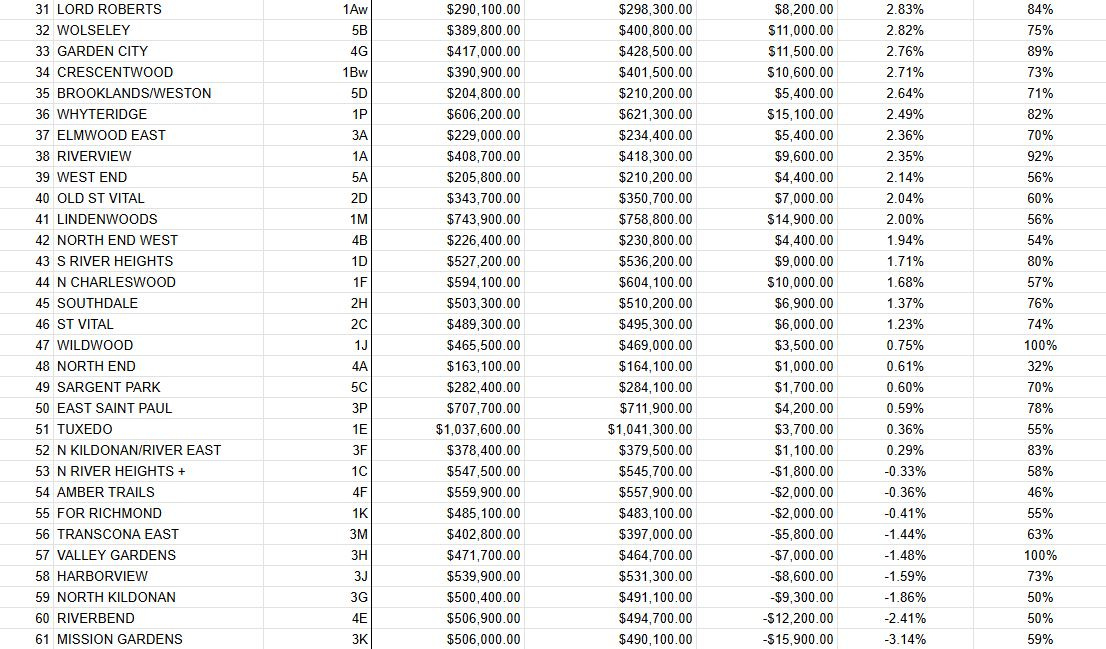

Most Areas Have Recovered—And Then Some

Only 10 MLS areas across the city still haven’t cracked their 2022 peak prices. That means nearly the entire city has either matched or surpassed its previous high-water mark.

But here’s the catch: the ones still lagging? They almost all sit in the upper-$400K to low-$500K benchmark range. In other words, the upper-middle of the market.

And right now, that price bracket feels like real estate limbo. A $499,900 listing could be the best house on the block, the worst in the neighborhood, or completely average depending on which part of town you’re in. It’s inconsistent, and buyers with this budget know it. Ask 3 different realtors to describe a $499,900 house, you’ll get 3 different answers.

I suspect the stall in these areas is due to market fragmentation. Buyers with half a million to spend are being pulled in five different directions—character homes, new builds, move-in-ready, fixer-uppers, and wildly different locations. That kind of variety creates indecision, and indecision creates drag.

This market fragmentation is one of the core supporting arguments to my theory that the citywide benchmark price will top out at $472,000 by Spring of this year - the optionality beyond this level becomes too wide, and production of acceptable new construction becomes appealing to the point that the market will adjust itself before further major jumps can be made. This is all said notwithstanding a significant devaluation of our currency, but that’s for another article.

Some Areas Have Blown Past Their Peaks—Big Time

On the flip side, a handful of MLS areas are now averaging nearly 10% above their 2022 highs. That’s not just a bounce back—that’s a whole new market reality.

And while the vast majority of the city has landed somewhere in the 3–5% range above the 2022 benchmark, there are a few areas that have blown way past that. What's driving it? Logically, it is at least influenced by new construction.

There’s a noticeable skew in some of the areas that feature a mixture of existing and new or newer homes. See 4L and 1H as the most apt examples. As expensive new homes hit the market, the average from the previously existing construction only area will tend to rise beyond what demand alone would have produced. Use caution when pricing existing detached homes using these benchmarks!

Northwest Winnipeg Is Leading the Charge

Geographically, Winnipeg’s northwest quadrant is doing the heaviest lifting. This section of the city has posted the strongest gains of any numbered subsection—outpacing the rest very significantly.

It’s difficult to say whether it’s momentum from homebuyers craving the location, investors taking advantage of the high liquidity, or the relative affordability compared to the South driving these gains. New construction is almost certainly a factor, but genuine buyer demand appears to be nearly insatiable in many of these areas - particularly ones with slightly lower benchmark prices.

This is despite generally low absorption for most of last year, with certain seasons and certain sub areas experiencing brief boom and bust periods. Despite the slight volatility, the 4-starting areas are on top when considering this time frame for now.

Bottom Line?

The upper-middle markets have been slow to recover from the fallout of the aftermath of 2022, whereas a lot of the low to middle areas have rebounded a lot. The resurgence of some of the higher priced neighborhoods have put May 2022 buyers back in the green for the first time in a while. Additionally, homeowners in Winnipeg’s northwest have flexed so hard these past couple of year they almost broke the mirror, and the rest of the city is sitting nicely ahead and waiting to catch back up.

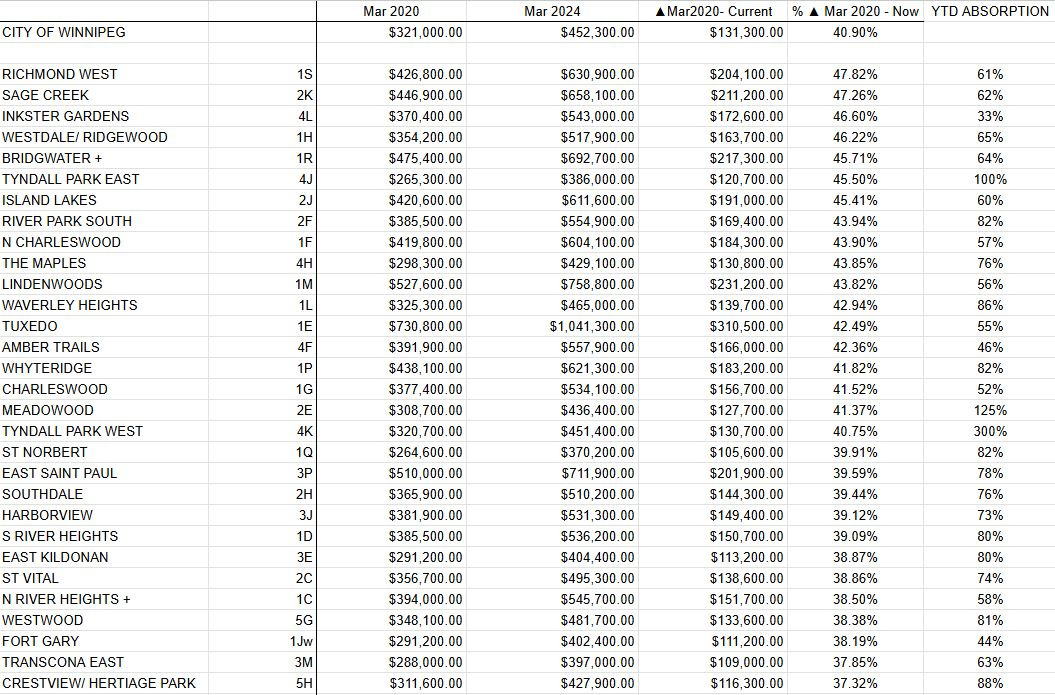

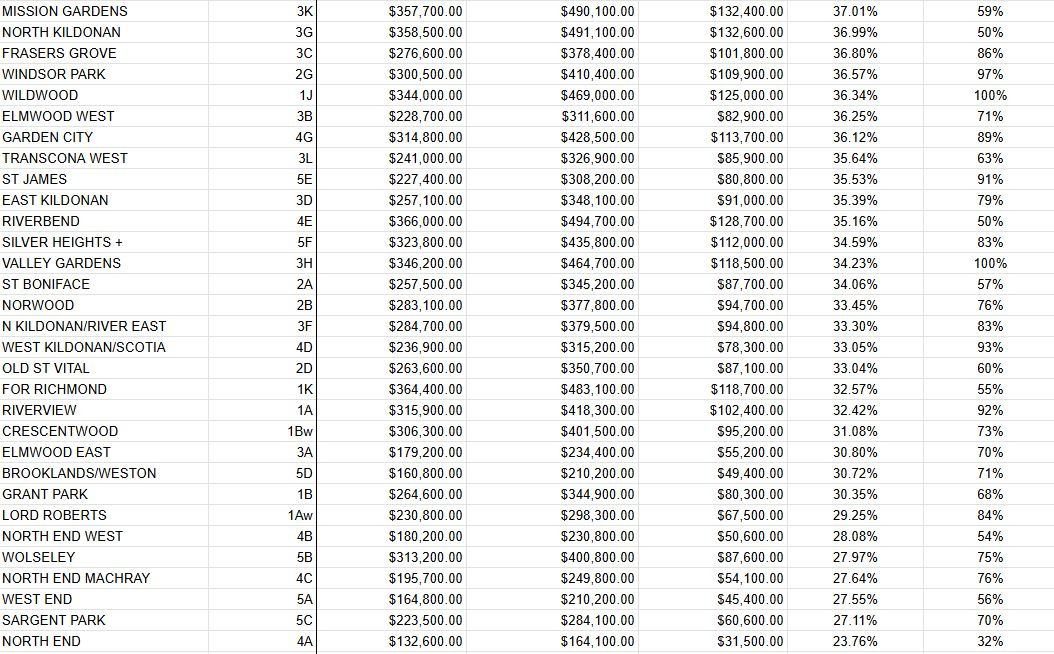

Section 3: Performance since March 2020

Five Years Later

It’s official—Winnipeg’s detached home benchmark is now up over 40% since the chaos of March 2020. That’s a massive leap, and it tells a story that’s hard to ignore: Winnipeg real estate isn’t just resilient—it’s thriving.

Familiar Names Still on Top

Looking at the best-performing neighborhoods since the May 2022 update, the leaderboard hasn’t changed much. The same top-tier areas are still dominating, and what stands out most is the average price point—roughly $600K.

It’s worth noting how consistent this is with the previous dataset. This isn’t a one-off hot streak. These are sustained gains in areas with long-standing desirability, and that trend is showing no signs of slowing down.

The 30–40% Club

Across the board, the vast majority of Winnipeg neighborhoods posted 30–40% appreciation over the last five years. It leaves me with very little to discuss, as most of the interesting stuff comes at the extreme ends! Even in the face of rising interest rates, inflation fears, Trump fears, Elections, and general market uncertainty, Winnipeg delivered in the long term once again. Only a very short list of neighborhoods fell significantly short of the benchmark average over the last 5 years, and most of them recently, have been performing rather well.

Final Thoughts

At the end of the day, the takeaway is simple: If you’re investing in Winnipeg real estate, you don’t need to hit a home run to win. Buy almost anything. Hold it long enough. You’ll probably do just fine.

I hope this update brought you some value or at least gave you a few things to think about. As always, if you want to chat numbers, trends, or strategy, I’m happy to dive in.

Until next time—stay sharp, and keep watching the market.

Keenan Brown

204-955-0173

keenanbrownrealtor@gmail.com