Winnipeg Home Price Index Update - APRIL 2025: Data From MARCH 2025

The big Canadian markets might be tanking, but Winnipeg real estate is skyrocketing!

MARCH 2025 HPI Update

MARCH 2025 Winnipeg Benchmark Price: $452,300 (up from $436,000 in January)

Year to date: +9.01% (was 5.09% last month)

Month over month: +3.92% (was 3.15% last month)

From 2024 High: +7.00%

From Former All-time High (May 2022): +5.41%

Prices continue to skyrocket! The March benchmark price surged by 3.92%, leaving the former all-time high (May 2022) in the dust. Supporting data—such as supply, sales figures, and average sale prices—are exceeding expectations, while declining rates are fueling the upward momentum. The signs point to a Spring market that’s set to take off even further.

Broader Context: What happened in March?

March was characterized by the ongoing political discourse that has dominated conversations since January. We saw another 0.25% interest rate cut and the official call for a Federal election to occur on April 28th. With the Liberals surging in the polls, the Conservatives scrambling to hold on, and all other parties reduced to mere footnotes, Canada’s political landscape has become strikingly binary.

Both major parties have made housing affordability a high priority, with each platform specifically citing major markets like the GTA and GVA as areas of concern. For Winnipeg, however, proposals such as a full GST rebate on new homes, reduced building permit costs, or new “NIMBY” penalties are unlikely to have any significant short- or medium-term impact on the pricing of existing homes. I remain confident that the Winnipeg benchmark price will continue to rise until it nears—or even exceeds—the cost of an reasonable newly built home, which is currently around $475,000.

The Bank of Canada: Next announcement April 16th

Following the March 12th rate cut, the Bank of Canada indicated they plan to hold rates steady at the April meeting. They cited concerns over the tariff war and a notable resurgence of inflation—particularly housing inflation—as key factors. With most mortgage offerings for 3- or 5-year fixed terms now hovering in the upper 3% to low 4% range, the environment for mid-market borrowers seeking family homes is more attractive than it has been since Spring 2022.

The Rest of the Country: How do we compare?

Winnipeg is standing out amongst most of Canada’s other metro real estate markets. Specifically, the Greater Toronto Area has seen continued significant pricing declines in their condominium market, and a failure to launch in their detached home markets for 2025. With prices still sitting between 5% and 15% from the all-time high, it’s unclear if reprieve for the buyers at the top is going to come this year or much later.

Calgary, Halifax, Montreal and Edmonton are all experiencing gains similar to or in excess of what we’re seeing in Winnipeg. The price points for these markets vary, but they remain far lower than the two biggest nationwide.

Accountability Check: How are my predictions doing?

On December 27th 2024, I predicted the March 2025 Benchmark price would be $450,000. At the same time, I predicted a price of $456,600 for April 2025.

Advice for Buyers and Sellers in Today’s Market

For Buyers:

In terms of strategy, nothing has changed since last month. Supply remains tight, and competition is more fierce than we’ve seen in years. Expect most mid-market homes to sell for significantly over asking price, and be prepared to lose a lot. DM me if you’d like to discuss your personal situation, but here’s some tips for winning as a buyer in this challenging market:

Be prepared to pay 10% more than the comps suggest. Most pricing data is pulled from 6-12 months ago, and we’re currently up over 9% year to date. Continue to comp properties out, but understand those numbers aren’t available anymore. You have the upper hand just from reading this.

Don’t get discouraged. When 20+ buyers bid on the one house listed for $324,900 in Westwood and it sells for some ridiculous number, don’t take it personally. That’s one less wild buyer you’ll have to fight as we move through to the summer months. Stay the course, the right house will come.

Be patient, and keep an open mind. This is the time of year where considering alternative neighborhoods can yield big results. Be patient, but keep an open mind to nearby similar areas you haven’t shopped in yet! Great opportunities can often be found off the beaten path.

For Sellers:

Sellers, it might be the best time to sell since Spring 2022! With nearly every type of residential property selling for prices never before seen, it is very likely you’ll be exceedingly happy the outcome of your listing.

In terms of strategy, listing on the lower side of the value spectrum is proven to yield very strong results for most mid-market homes right now. It isn’t required, the market is strong enough to absorb properties sitting at higher numbers, but those are less likely to set off fireworks on offer date.

If you have a more unique or hard to value product, maybe in a less desirable area, or a high-end price class, now could be a great time to take offers on an as-received basis! With most purchasers being forced to wait until the following Tuesday evening to get their offer declined, your listing may stand out and create urgency by allowing them to buy it right away. What a crazy thought!

SUPPLY MARCH 2025:

February 2025:

March 2025:

The March supply data was one of the most impressive I can remember in a very long time. With a very average number of homes coming to market, above average uptake, very high average sales prices, and very high transaction volume overall, this March essentially delivered in every possible category.

Month over month, the total supply of listings currently available is staggeringly similar to February, but this is an illusion created largely by the existence of offer dates and assisted by the accumulation of supply in Winnipeg’s least desirable areas

Absorption Data:

As expected, the citywide rate of absorption plunged hard into seller-favored territory, with a full uptake cycle taking only 2.6 months - a rate similar to what we saw at the peak of the market in 2024.

With the surrounding data showing the strength it is, I anticipate this chart to continue to move in a seller favored direction at least until June of this year.

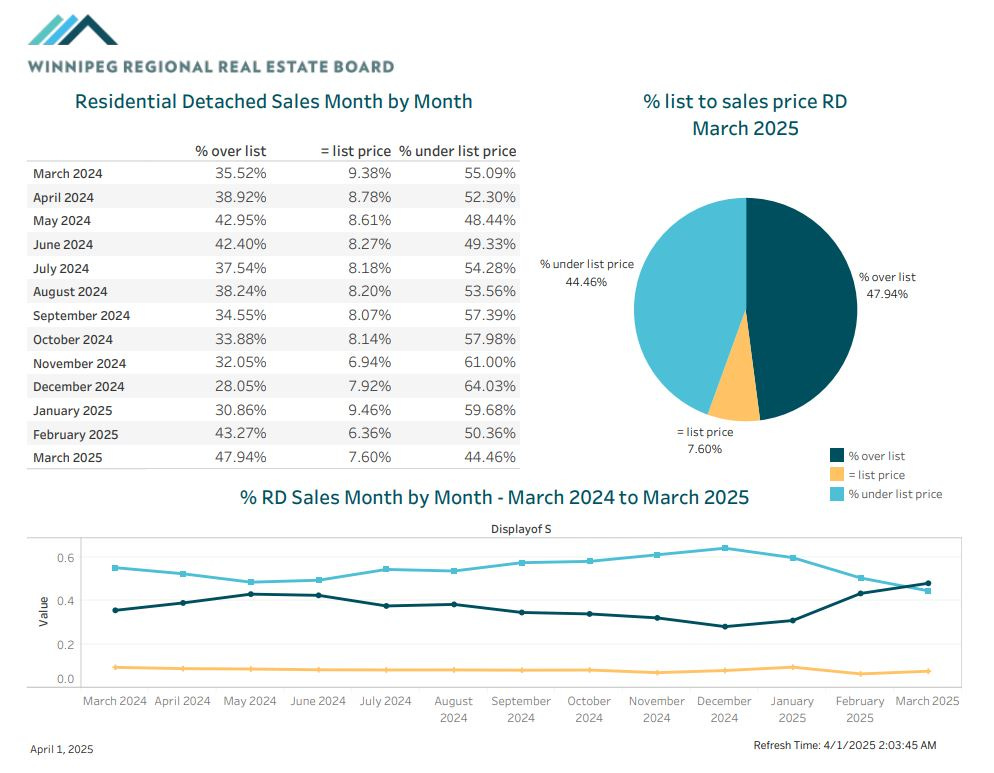

BIDDING WARS - OVER OR UNDER

For the first time since June 2022, we officially have an inversion! This is the first time in a long time that more homes have sold over list than under list, with 55.56% selling at or above asking price. This phenomenon underscores the current market strength and confirms that pricing attractively and inviting offers is the winning strategy.

In rapidly accelerating markets like the one we’re experiencing right now, it is not materially possible to price the average property accurately within a few thousand dollars. The market is simply moving at a rate beyond the scope of most of the comparables. With this in mind, pricing attractively, and inviting opinions of value in the form of offers appears to be the king strategy for the current season. Expect more of this in April!

Author’s Note: Pricing strategy is highly personal and situational. Before making any pricing decisions—whether buying or selling—reach out for a free consultation:

📞 204-955-0173

📧 keenanbrownrealtor@gmail.com

📱 @keenanb_ on Instagram

SALES BY AREA REPORT

Guide on MLS area codes:

ANALYSIS

Here’s some of the hottest neighborhoods so far this year. Due to popular request, only areas with 90%+ absorption will be listed until further notice.

1A - Riverview - 92%

1J - Wildwood - 100%

2E - Meadowood - 125%

3H - All Seasons - 100%

4D - West Kildonan - 93%

4J - Tyndall Park West - 100%

5E - Saint James - 91%

Stay tuned for my area analysis article coming later this month!

The trend of entry level, or in other words, areas priced below the benchmark price and still generally regarded as desirable neighborhoods have continued to perform extraordinarily well this year so far. 4D West Kildonan and 5E Saint James are major standouts, with their average prices hovering in the lower reaches of the $300,000 range.

2E Meadowood and 3H All Seasons remain at perfect absorption or better for the year so far. Both of these areas were among the top performers of 2024, and have experienced a striking ascent to prices into and above the range of the benchmark price for areas which formerly were seen as somewhat “affordable siblings” to the nearby more desirable areas.

Possibly most interestingly, there are only 9 MLS areas in all of Winnipeg remaining with an average sale price of less than $300,000. As recently as December 2019, the Winnipeg benchmark price was $306,200. We analyze broad market movements and statistics all the time, but a figure like this really puts the nature of housing affordability citywide on clear display.

Here’s a short list of neighborhoods I’m keeping a close eye on right now:

4D - West Kildonan/Scotia (93% this month)

I’m very impressed by 4D holding up so incredibly well for so long! The high level of interest for the area has been something I predicted a long time ago. As many of you are aware, back in 2020 I put my money where my mouth is and bought in the neighborhood for myself. This is a trend I’ll certainly watch in the short term. Qualitatively, it’s easy to notice the gradual but significant changes in the area.

1R -Bridgwater + (63% last month)

This area has interested me for a long time, as it frequently was inundated with new supply from builders keeping the absorption figures low. However, with builders rapidly pumping out supply in Bison Run and Prairie Point at very very low prices, the broader market seems to be taking it very well. In fact, 1R is performing nearly as well as the highly desirable 1M Lindenwoods area in terms of pricing growth and absorption YTD - an unusual sight! Also - ask me about my newest listing in this neighborhood!

5A -The West End (56% last month)

5A has been a somewhat troubled area over the years for several reasons, but with virtually all of the surrounding areas experiencing supply crunches and intense bidding wars, 5A may finally succeed in pushing past and STAYING past the $200,000 average price mark — something it’s had a hard time doing for the past several years. It barely cleared $200,000 this month, I am keeping an eye on it to see if the area can finally make some long awaited gains.

Takeaway:

Here are the key points from today’s market update:

The Benchmark Price rose 3.92% month over month to $452,300, continuing to increase significantly past the 2022 high.

Absorption remains strong, with high sales activity across most areas, and little supply lingering on the market.

Bidding wars are everywhere! Over 55% of detached homes sold at or above asking price in March 2025 with no signs of slowing down.

Average prices continue to climb! With only 9 MLS areas featuring average sale prices under $300,000, the Winnipeg market is becoming increasingly difficult to enter for first timers.

For deeper insights, read my Performance Analysis and 2025 Predictions articles, with the latest installment coming in a couple short weeks!

Need advice? Let’s chat!

📞 204-955-0173

📧 keenanbrownrealtor@gmail.com

📱 @keenanb_ on Instagram

As always, if you find these updates helpful, please subscribe—it’s 100% free and always will be!