Winnipeg Home Price Index Update - Data From June 2024

Welcome to Q3! Prices are once again up, but after experiencing our first rate cut in four years some data indicates we may have hit the top for the 2024 market season.

Welcome to Q3! Prices are once again up, but after experiencing our first rate cut in four years some data indicates we may have hit the top for the 2024 market season, although nothing is guaranteed.

A podcast version of this update will be available on July 8th 2024, which will strongly focus on finance, interest rates, and market direction heading into the end of the year. This is not an episode to miss! As always, if you find these updates helpful, please subscribe (it’s 100% free and always will be!)

June 2024 HPI Update

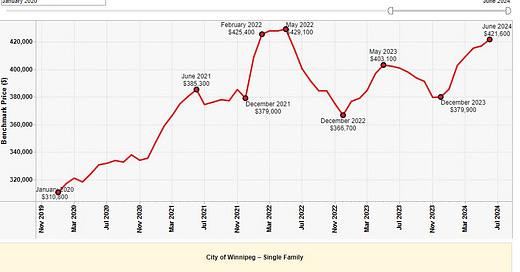

June Winnipeg Benchmark Price: $421,600 (up from $416,900 in May))

Year to date: +10.98% (Was +9.74% last month)

Month over month: +1.13% (Was +0.39% last month)

From All-time High: -1.75% (Gain of +1.78% required to return to ATH from here)

Ladies and Gentlemen, we have liftoff! Following the widely anticipated interest rate cut on June 6th, the Winnipeg real estate market has continued to push it’s way upwards to $421,600, which is only sniffing distance from the May 2022 all-time high. This strong month of price gains implies our market has, on average, increased by nearly 1.8% PER MONTH since December 2023 - a pace of change we haven’t seen since the pandemic era. Despite the news of the recent rate cut and the very strong pricing gains, some of the data is once again suggesting we may be due for a seasonal reversal coming in very shortly.

In the last market update, I wrote the following:

“At the time of writing, June 3rd 2024, I am not expecting the US central bank to cut interest rates, as their markets seem strong and growth is continuing without need for assistance, while I am completely unsure what the Canadian central bank will do. Typically, the Canadian central bank tends to follow in near lockstep with the US, but our national situation regarding employment, real estate and our markets in general is certainly less strong than theirs. For that reason, I think it is very likely we see the beginning of rate cuts in Canada, but I do not think the US will cut on the 6th. Feel free to comment on this post on the 7th and make fun of me for being wrong!” - May HPI Update, published June 3rd 2024.

My prediction came exactly as predicted, with Canada cutting rates of the 6th, and the US taking no action the week following. The July decision will likely be more interesting, as some less-than-favorable data has recently reared it’s ugly head in Canada, which may encourage the Canadian central bank to take a little break on further cuts. Tune into the podcast on July 8th to hear mortgage and financial expert, Ryan Mackenzie with Exzact Mortgages break down everything you’ll want to know about interest rates going forward.

With the supply data looking stable, and most common metrics holding or only deteriorating slightly, the overall health of the market appears to be rather strong. Anecdotally, most agents and investors I’ve spoken with have been beginning to sense a shift in sentiment, which is natural for the time of year.

For you investors out there, this is the prime time of year for good opportunities to go unnoticed. You need to be watching the MLS now more than any other time of year. There are great deals out there that are being missed to due complacency and time of year. Get out there and buy them!

For you homebuyers reading, you need to watch closely for desirable listings priced artificially low, and move in quickly with an acceptable offer on offer night. It is astounding common how often your “asking price” offer can get accepted on a house clearly priced looking for bids. Be smart, shop aggressively, and do not be shy to throw at or just under asking price offers out on an offer night. There’s less competition than you think in many areas!

Sellers, don’t execute a spring strategy in July! Pricing your $280,000 listing at $249,900 and hoping to get carried upwards has never been more dangerous than right now. You need to be pricing closer to value, with or without an offer date, or you risk getting your listing taken for asking price by me and my clients. This applies to all price ranges. Don’t make the mistake of asking for too much though, you don’t want to price yourself out of the market entirely!

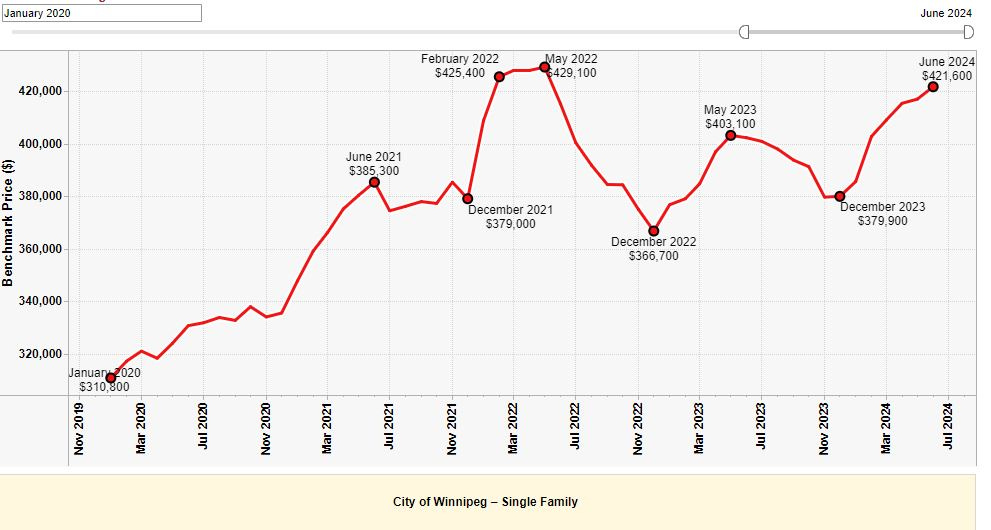

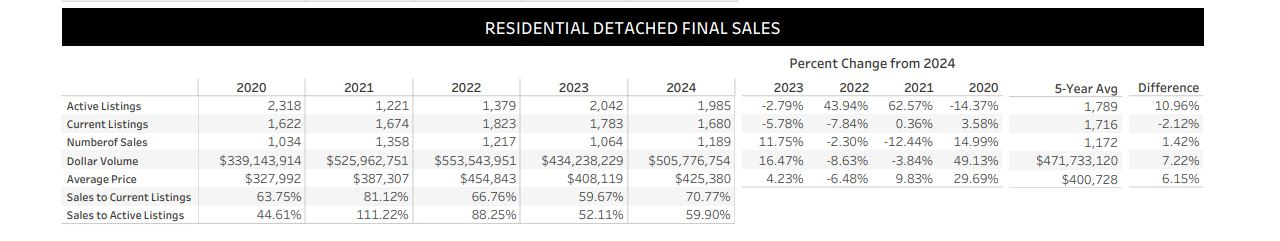

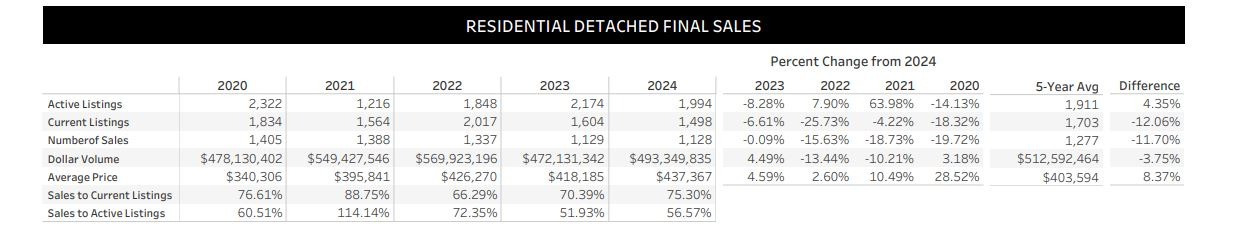

SUPPLY June 2024:

May 2024 Data:

June 2024 Data:

While reviewing the data for June, I had to check multiple times to make sure I was looking at the right month, as the data was so starkly similar to what we saw in May. Active listings overall are at a very similar level, although there’s about 200 fewer current listings, number of transactions is very slightly down, dollar volume is slightly down, and average price is up rather starkly, and still dramatically exceeding the current HPI. This came as a big surprise to me, as I viscerally felt the market shift about two weeks into June, and I expected the supply data to be far softer than it came out.

Considering the improving supply situation, and the increase in the average sale price, I’m shocked I’m writing this, but I think it is entirely possible the July HPI is higher than the June HPI. I am not expecting this to be the case, but we have a situation in front of us with July being primed for the top, and a slow taper down into Winter following that.

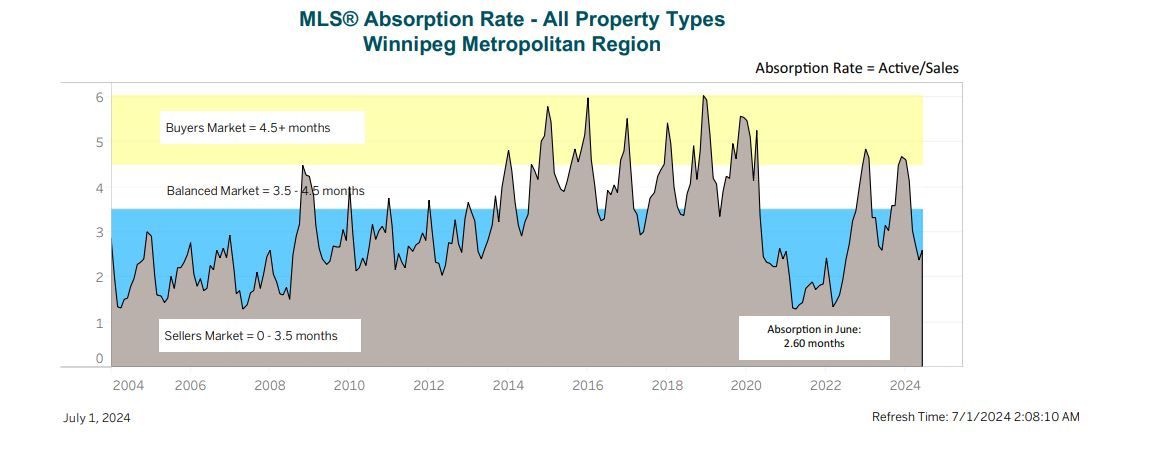

Absorption Data:

For the first time in 2024, we saw absorption citywide move slightly back in the direction of buyer favored. Don’t get me wrong, the market is still highly liquid, and definitely seller favored overall, but this slight reversal to me acts as an indicator that dramatic month over month pricing gains are likely to stop very soon - possibly this month. This is natural for the time of year, and I expect this process to play out slowly over the next 6 months of data, peaking with a slight buyer favored market occurring sometime around December 2024.

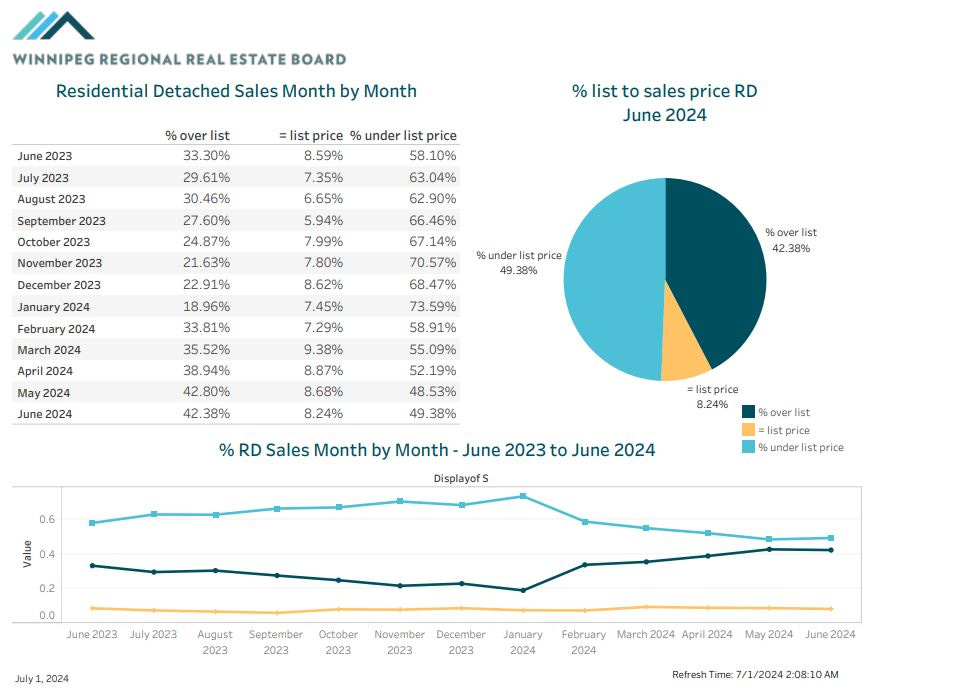

BIDDING WARS - OVER OR UNDER

The bidding war trend appears to have continued very strongly throughout June, with only a slight decrease in the number of homes selling at or above asking from May having occurred. According to the statistics, it remains the case that over 50% of homes on MLS sold at or above asking in June, which I found rather surprising. I still believe much of this data was influenced by the early stages of the month, and the situation post-Canada Day is different than the market situation we were facing on the 1st of June. Price your listings more modestly, and expect this chart to diverge shortly!

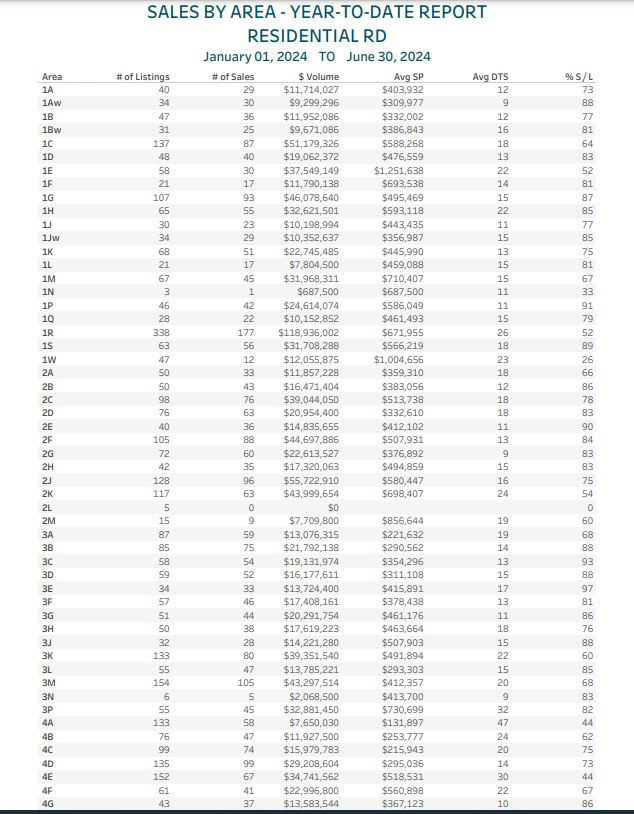

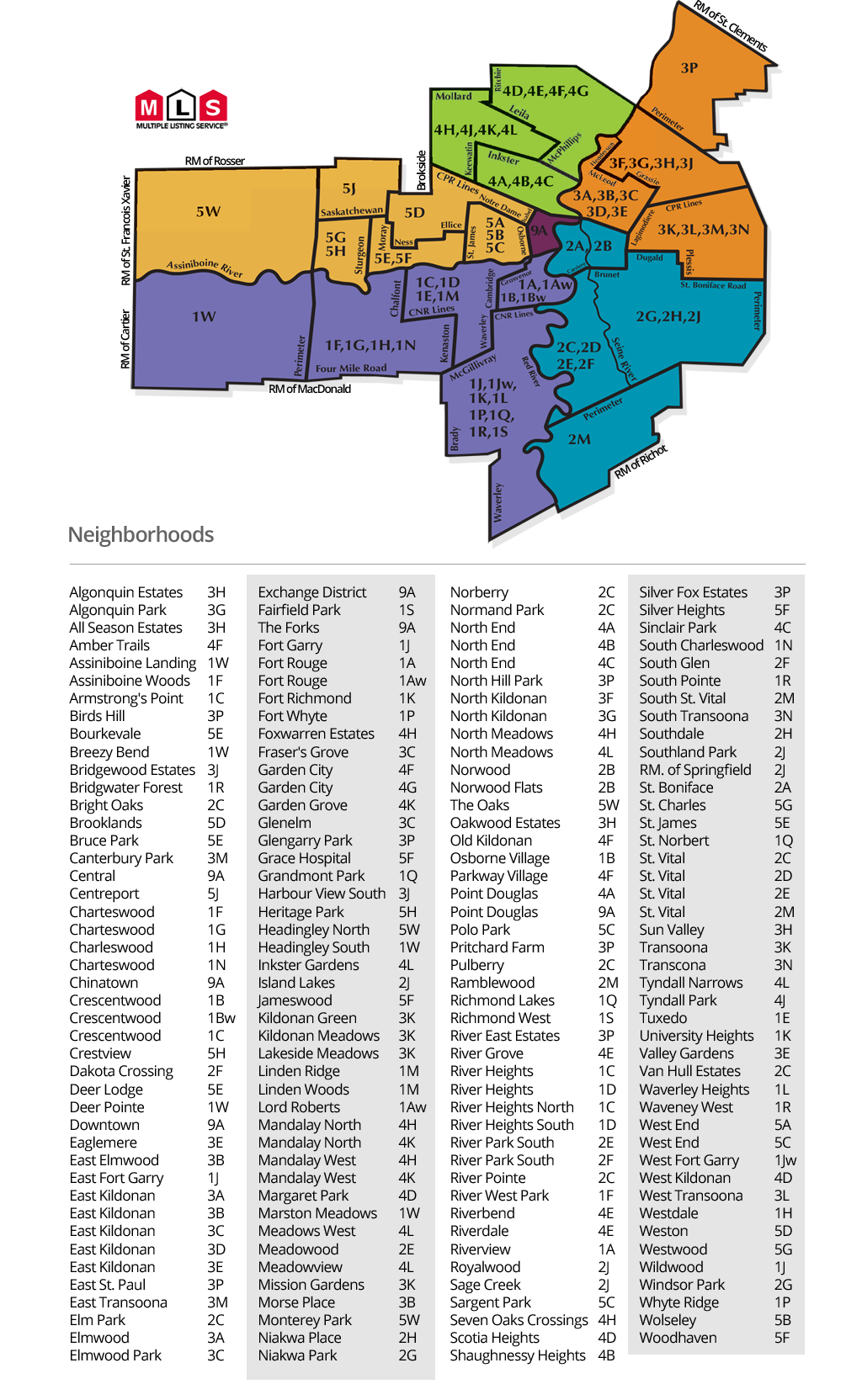

SALES BY AREA REPORT

Guide on MLS area codes:

I’d classify absorption numbers as follows (From a YTD perspective):

85%+ = Extremely hot. Almost everything is selling on an offer day, not much is on the market.

70%-85% = Hot. most listings are selling, bidding wars happen, listings don’t sit long.

50-70% = Balanced. The best listings and best priced listings will sell without trouble, but greedy sellers and buyers may be in for disappointment.

35-50% = Cold. Most homes aren’t selling easily. There is likely a lot of supply on the market and most listings are stacking days on market with little attention.

< 35% = Extremely cold. The area is saturated with listings, very few properties sell quickly, very few buyers shopping in the area.

ANALYSIS

Here’s some of the hottest neighborhoods by absorption in 2024 (about 85% or higher):

1Aw - Lord Roberts - 88%

1G - Charleswood - 87%

1H - Ridgewood West / Westdale - 85%

1Jw - Fort Gary - 85%

1P - Whyteridge - 91%

1S - Richmond West - 89%

2B - St Boniface/ Norwood - 86%

2E - Meadowood - 90%

3B - East Elmwood - 88%

3C - Glenelm & Fraser’s Grove - 93%

3D - Mid Kildonan - 88%

3E - Valley Gardens - 97%

3G - North Kildonan - 86%

3J - Harborview South - 88%

3L - Transcona West - 85%

4G - Garden City - 86%

4J - Tyndall Park East - 90%

5E - Saint James - 89%

5F - Silver Heights & Woodhaven - 86%

5G - Westwood - 94%

5H - Crestview - 96%

Some truly staggering numbers again for June!

Once again, the biggest standout point of this update is the continuation of the massive absorption occurring in the areas starting with a “3” - Essentially all of the Kildonan areas + Transcona and Harborview, except this month including 3B - East Elmwood! The money in this area continues to push further and further south as the year continues, with more buyers being priced out of 3G and 3F, and therefore choosing to shop in the more affordable southern areas. Unfortunately for them, the absorption is getting pretty tight there too, leaving all of the MLS areas starting with a 3 under sustained and substantial pressure. Now that the 3G sellers have had a chance to show off their pristine lawns, it looks like they’re deciding to list, and the buyers are deciding to buy. It is nice to see the best part of the Kildonans back on the list this month. Expect this trend to continue, as active options in all of these areas continue to be quite limited.

West Winnipeg also continues to be on fire, with some truly unbelievable numbers coming from Westwood and Crestview in particular. Despite the relative cooling of 5B, everything west of Route 90 has been on a complete rampage this year, with most areas experiencing top tier absorption for nearly the entire calendar year. If I were to list a home in Westwood or Crestview right now, I would not be afraid to ask for a little more than usual right now! I should add, 5C was likely only 2 listings selling away from hitting 85% this month - which is great to see for one of Winnipeg’s premiere starter neighborhoods!

The areas beginning with a 2 are also doing rather well, but their numbers aren’t quite as eye-popping as some of the previously discussed areas. Most of the data shows the 2-starting areas to be consistently between 70 and 90%, with a ton of big-ticket neighborhoods hovering just under our 85% threshold to make it onto the list. I consider all of these neighborhoods very healthy, and I think they are performing fine, but I would not be pricing listings in there with the expectation of creating a new comparable.

Here’s a short list of neighborhoods I’m keeping a close eye on right now:

5H - Crestview (96% this month)

I’m watching this because it’s just too crazy - 94/98 listings have sold in here year to date, and most of the active supply is still awaiting offer dates. Truly shocking to see. I am not currently shopping with anyone in 5H, but if I were I know I’d have my work cut out for me!

1P - Whyteridge (90% this month)

I am currently working with a buyer considering this area among several others, and I have been very surprised at the sustained high level of activity in this neighborhood for the last few months. The area has an abundance of really nice homes, but it also has it’s fair share of stinkers, and I’m surprised at the rate of uptake of the stinkers! Pricing in here is starting to get high, but so is everything around it. Either way, I’m watching this.

5C - Sargent Park and the West End (83% this month)

Due to the very high volume of business I have done, and will continue to do in this area, I have been watching the data very closely. In June, 5C performed really well! At 83% absorption, 5C is showing a ton of strength heading into the summer market. Best of all, prices seem to have accelerated only modestly compared to the rest of the city, meaning this can still be a wonderful place to buy a fabulous start home for less than $300k.

Takeaway:

Here are the key points from today’s market update:

The HPI index rose 1.13% month over month, up to $421,600 and is down about 1.75% from the all-time high.

Supply metrics were very strong in June, with similar numbers of active listings, but fewer current listings than May. Transaction volume remained high, and the average sale price was considerably higher than May, and higher than the current HPI.

Bidding war prevalence decreased slightly in June, but is still running very hot at over 50% of homes selling at or above asking price. It seems likely this will not continue throughout the summer, but given some further rate cuts, anything is possible.

Winnipeg continues to experience incredible absorption in the North East, the West and the South West, with solid buying opportunities being available in the North West and South Eastern sections of the city.

Stay tuned for the next article, leave a comment if you found this helpful, and feel free to reach out if you would like to discuss anything in further detail.