Winnipeg Home Price Index Update - December 2023 Year-End Review

A review of the December 2023 Winnipeg real estate market data

Welcome back for another HPI update! 2023 is now in the books, and we’ve got a ton of new & exciting information to cover going into the new year!

Posting these market updates publicly in 2023 has been a massive success! Thanks everyone for your kind words of encouragement and appreciation. Let’s make 2024 even better!

December 2023 HPI Update

November Winnipeg Benchmark Price: $380,000 (up from November ($379,800))

Year to date: +3.57% (Was +3.52% last month)

Month over month: +0.05% (Was -2.96% last month)

From All-time High: -11.48% (Gain of +12.97% required to return to ATH from here)

I began the last HPI update with the statement “I was wrong”. As many of you are aware, for approximately the past 6 months I have been suggesting the Winnipeg benchmark price would fall from the May highs of ~$400k down to between $380k and $390k before climbing higher again in the spring of 2024. On several occasions, I had also stated that I did not believe the benchmark would experience a 7-10% drop in Q4 2023 like it did in both Q3 and Q4 2022. When the December data came out, I found the price stabilization which bumped the benchmark back up to precisely $380,000 very pleasantly surprising - like a late Christmas gift! The benchmark finished off the year at a healthy +3.57%, which is a fantastic year for the city outside the context of the gains from the pandemic years. I believe the 2024 market year will take a very similar form to 2023. For further details on all of my 2024 Winnipeg real estate predictions, please check out my previous article.

The December data overall paints quite a rosy picture of our current market conditions. Despite traditionally being the slowest month of the year in real estate in terms of both number of transactions and number of new listings, this December has surpassed nearly all of my expectations - Price, supply, multiple offers, absorption and area data all performed far better than I had anticipated. After reviewing all of these metrics, it became clear to me that this December data appears to position our market in a remarkably similarly manner to December 2022, or possibly even better.

December 2023 was the first month in nearly a year and a half where both the Canadian and United States central banks begin indicating that some interest rate cuts were on the very near horizon. Specifically, on Wednesday December 13th, the US Federal reserve held its key interest rate at the target level, however they provided guidance that they’ve penciled in “at least 3 rate cuts in 2024” - Per Jeff Cox CNBC. As the Canadian central bank tends to follow suit with the actions of our neighbors to the south, it is probable we will experience something similar on our side of the border. As a result of this announcement, there was an almost immediate reaction in bond yields, and mortgage interest rates rapidly followed. If these rate cuts come to fruition this year, I am expecting an even stronger rally into the Spring than we saw in 2023, and I believe the high prices will fall far less significantly towards the Fall and Winter months.

SUPPLY December 2023

November Data:

December Data:

Starting off with supply, the number of active and current listings once again fell on a month-over-month basis, however this time the amount is almost exactly in line with previous years. Year over year, current listings remain quite low even when compared to the pandemic era, however the total active listing count is still above 2020 and 2021 levels. Overall, the data for December 2023 looks very similar to December 2022, which I find very promising heading into the new year.

I’ve been repeating this for months, but it remains the case that the best of the new stuff is not lasting long on the market. The supply of new listings continues to fail to outpace demand, and the majority of the homes sitting without a buyer have been doing so for quite a long time.

Transaction volume overall remains depressed from the pandemic era highs, although the December data indicates that sales figures remain above 2022 levels, and roughly in-line with 2019 figures. Averaging out the last 5 years, total sales volume is only about 16% below the historic average, which I would not personally consider a concern.

Absorption Data:

As previously discussed, the absorption chart behaved exactly as-expected, officially landing the Winnipeg real estate market in aggregate into “buyer’s market territory” for the first time since January 2023. I do not expect this to be the case for long, as the state of supply and buyer demand citywide appears to only be improving towards seller-favored, and seasonality will begin to take hold.

It remains my opinion that we won’t remain in the buyer favored zone for long, and a dip back down towards seller favored will occur likely sometime in the early stages of spring/late stages of winter in 2024.

There are still ample opportunities to buy great homes, rental properties, flip projects and multi-family on MLS today. Many of these listings which sat on the market for months towards the end of 2023 are about to be viewed by a fresh set of eyes with shiny new mortgage pre-approvals at lower interest rates. If you’re in the market to buy, I’d suggest now would be a good time to start shopping.

BIDDING WARS - OVER OR UNDER

Once again, December took a surprising turn from the trends we’ve seen over the past few months with more homes selling at or above asking price than November, leaving the overall rate somewhere very close to what we saw in October. Year over year, this December massively outperformed December 2022, with ~32% of homes selling at or above asking this year compared to only ~21% in 2022.

The bidding war trend remains to be more prevalent at the lower to middle list prices, however this is certainly not always the case. After reviewing the data and evaluating my own experiences in the market, I have found most multiple offer activity occurring on listings under roughly $425,000, with bidding occurring very commonly in the mid 300ks. It will be very exciting to see how this trend progresses into the new year, I already can’t wait!

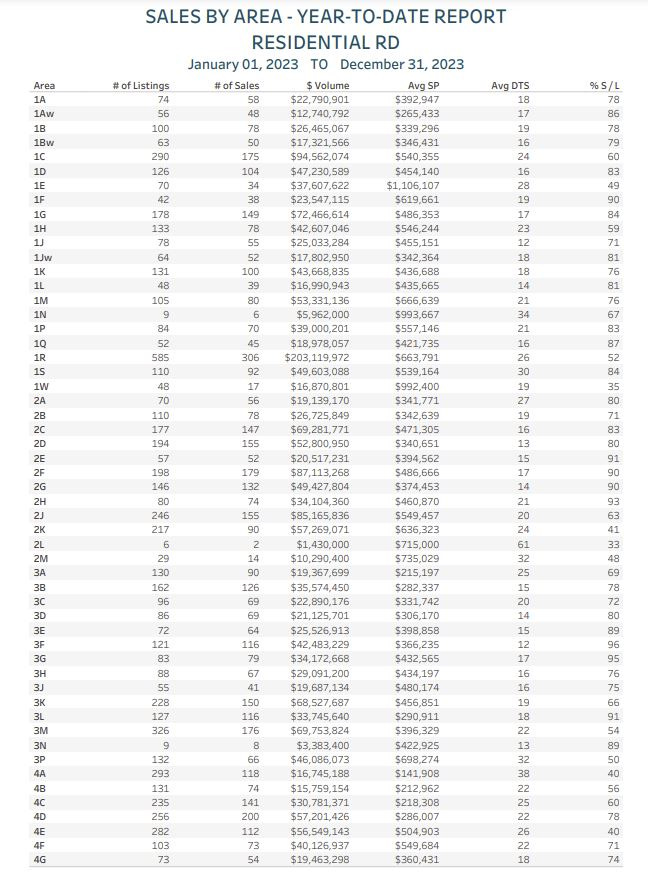

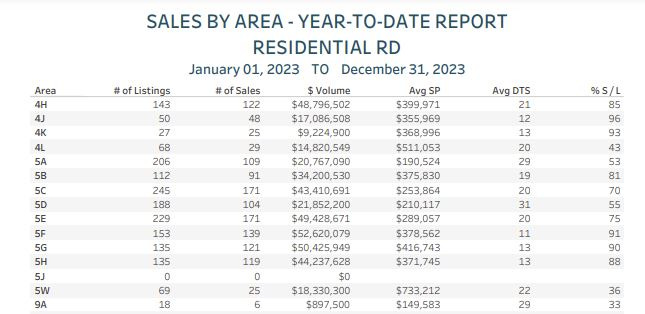

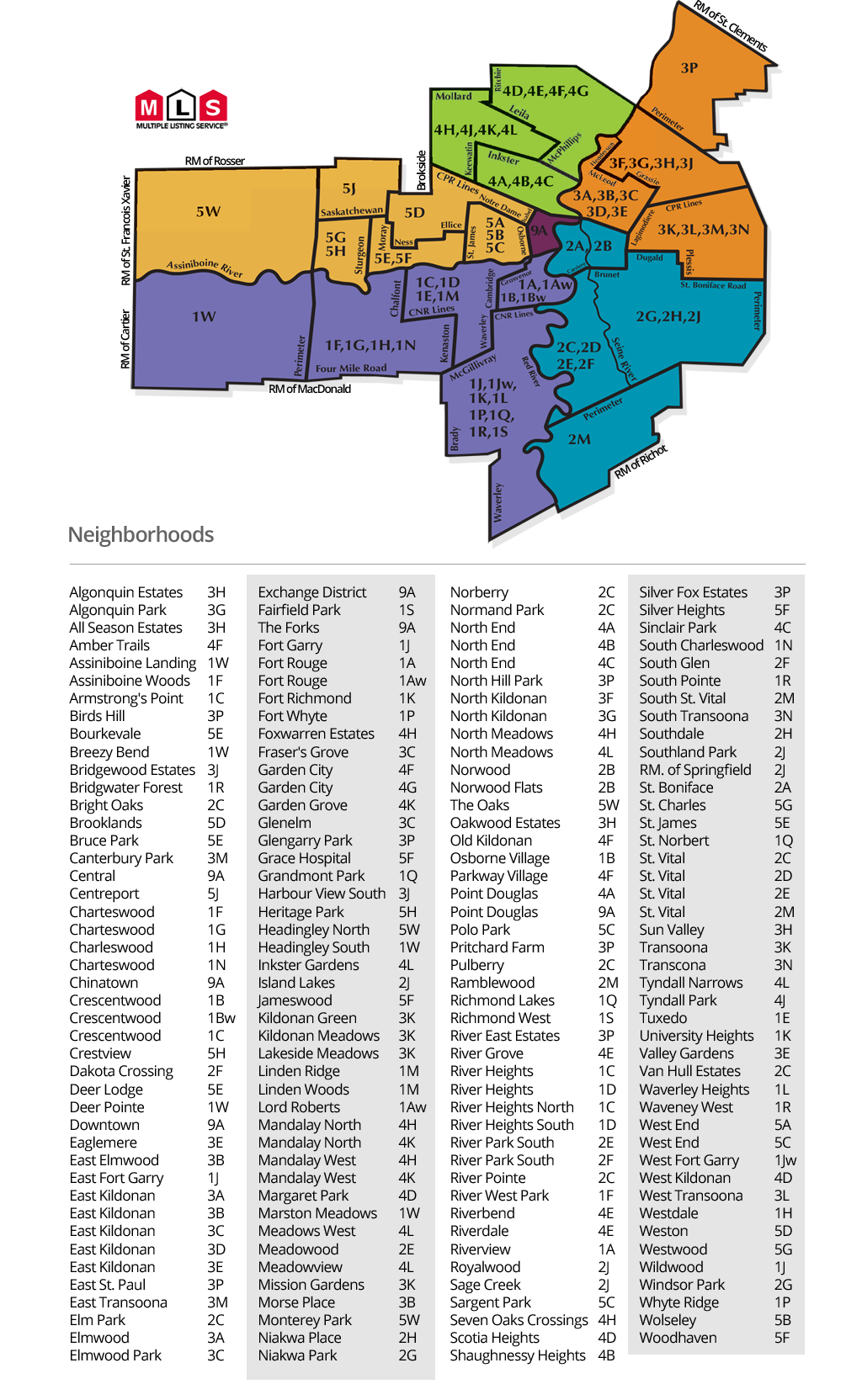

SALES BY AREA REPORT

Guide on MLS area codes:

I’d classify absorption numbers as follows (From a YTD perspective):

85%+ = Extremely hot. Almost everything is selling on an offer day, not much is on the market.

70%-85% = Hot. most listings are selling, bidding wars happen, listings don’t sit long.

50-70% = Balanced. The best listings and best priced listings will sell without trouble, but greedy sellers and buyers may be in for disappointment.

35-50% = Cold. Most homes aren’t selling easily. There is likely a lot of supply on the market and most listings are stacking days on market with little attention.

< 35% = Extremely cold. The area is saturated with listings, very few properties sell quickly, very few buyers shopping in the area.

ANALYSIS

Here’s some of the hottest neighborhoods by absorption in 2023 (about 85% or higher):

3F - North Kildonan (south) - 96%

4J - Tyndall Park East - 96%

3G - North Kildonan (north) - 95%

2H - Southdale - 93%

4K - Tyndall Park West - 93%

2E - Meadowood (St. Vital) - 91%

3L - Transcona West - 91%

5F - Silver Heights/ Grace Hosptial - 91%

1F - Southboine (North Charleswood) - 90%

2F - River Park South/ Burland - 90%

2G - Windsor Park - 90%

5G - Westwood - 90%

5H - Crestview - 88%

1Q - St Norbert - 87%

1Aw - Lord Roberts - 86%

4H - The Maples - 85%

The December/year-end sales data has once again confirmed the “low-middle list prices are king” thesis: The neighborhoods containing homes with average sale prices between roughly 325k and 425k are significantly out-performing the rest of the market and are more likely to be absorbed in any given month than areas outside of this price range.

This theme was a huge factor throughout the entire year, but it’s biggest impacts began to manifest in the most notable ways towards the end of the year. Notable higher-priced neighborhoods began to slowly slip in terms of absorption data as the year progressed, while the many of the more affordable average sale areas (looking specifically at 4J, 3F, 2G and 2E) picked up steam in the last ~3 months of the year.

That being said, areas such as Southdale (2H), North Kildonan (3G), River Park South (2F), and Southboine (1F) all performed extremely well on a year to date basis. One unique feature of these areas are the strong variety of price points. Most of these areas span several different price points but generally remaining in the middle to high end.

The winners for “Winnipeg’s hottest area of 2023” is a tie between Tyndall Park and North Kildonan, which should definitely not come as a surprise to anyone who’s been consistently reading these updates. 16 total neighborhoods finished the year at 85% absorption or higher, which means a huge percentage of Winnipeg by square foot is experiencing extremely strong sales activity. I’d take this as a huge positive going into the new year.

Given the relative strength of the December data, and the seasonality of our market kicking in, it is seeming more and more likely that prices will rise earlier than originally anticipated this year. Be prepared for early season bidding wars and relatively minimal new listings hitting the market over the next month or two! Investors - this is one of your last chances to pick up MLS deals that were missed. Sifting through active listings that didn’t manage to sell in late 2023 can be a great way to find value during the early stages of this market where it seems most new listings are selling extremely quickly. Best of luck out there!

Here’s a short list of neighborhoods I’m keeping a close eye on right now:

2E- Meadowood (St. Vital) - 91% (up from 88%)

This area had an interesting December, with only a couple listings, but both selling in massive bidding wars. I am eager to see how January unfolds here, as my suspicion is this will be one of the hottest areas by absorption next update.

4D - West Kildonan - 78% (flat from last month)

In December, 4D saw a fair amount of new listing activity, but nearly everything sold. This area appears to be quite balanced, with a great mix of new listings coming and new buyers picking up product. This area will remain on my radar for next month.

1E - Tuxedo - 49% (flat from last month)

1E finally experienced a sale in December 2023, however there were a total of 3 new listings. This is hardly a great sign for one of Winnipeg’s most expensive areas, but I’m still curious to see when and for how much the supply remaining from last year gets bought for.

1M - Lindenwoods - 76% (up from 73%)

Two consecutive months of increases here is contrary to what I was expecting for the end of year data. I seems reasonably likely pricing is close to bottoming out here for the year, and the 2024 listings will be priced more accurately in the early stages of the year. At the time of writing, certain segments of Linden Ridge haven’t seen a listing in nearly 3 months, so it’ll be interesting to watch the upper end of the price spectrum in this area.

Takeaway:

Here are the key points from today’s September market update:

The HPI index rose 0.05% month over month, leaving the index up 3.57% ytd, and down about 11.48% from the all-time high.

Supply metrics are more positive than last month, current listings are down from December 2022, while active listings overall are still elevated overall. The current market is very similarly balanced to December 2022.

December firmly pushed the Winnipeg market to the line into “Buyer’s Market” for the first time since Jan 2023.

Approximately 32% of homes sold at or above asking price in December, which is significantly better than December 2022 (21%), and better than November 2023 (30%)

Most areas featuring homes predominantly in the high 300 to low 400 price ranges are doing exceptionally well in terms of absorption. The higher priced areas are showing signs of life, however they are not being bought at the same rate as less expensive areas.

Stay tuned for the next article, leave a comment if you found this helpful, and feel free to reach out if you would like to discuss anything in further detail.