Winnipeg Home Price Index Update - MAY 2025: Data From APRIL 2025

First down month in 2025 - is the party over? Or is this a blip on the path?

MAY 2025 HPI Update

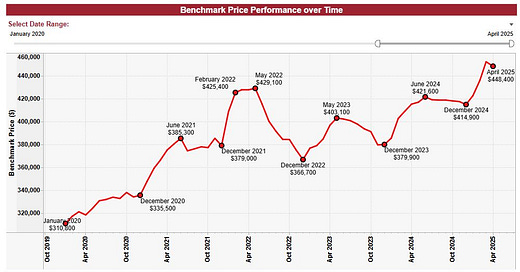

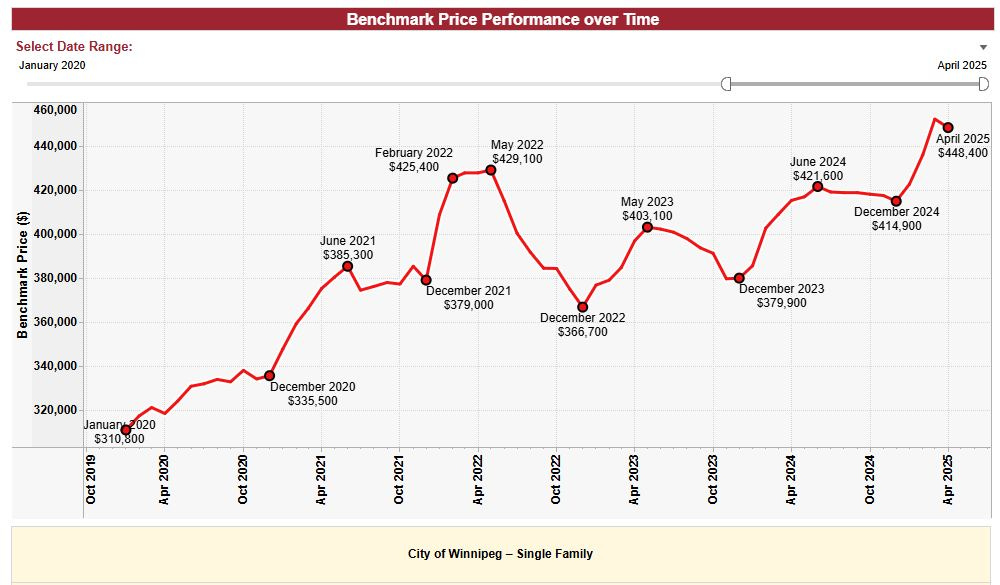

APRIL 2025 Winnipeg Benchmark Price: $448,400 (down from $452,300 in March)

Year to date: +8.07% (was 9.01% last month)

Month over month: -0.86% (was +3.92% last month)

From 2024 High: +6.08%

From Former All-time High (May 2022): +4.50%

In a surprising turn of events, the Winnipeg benchmark price saw it’s first negative month in April 2025 - a month usually know for explosive growth! While many metrics look strong in a vacuum, several important metrics did not meet expectations month over month. So is all hope lost? Or does the market still have room to run? Let’s break down what happened, why it happened, and what’s next!

Broader Context: What happened in April?

April was a chaotic month for Canada as a country for so many reasons. Most notably, we had our long awaited federal election, which resulted in a Liberal minority government. A mere 6 months ago, such a result would have been unfathomable, but with the changing geopolitical landscape, tumultuous US/Canada relations, and general nationwide economic uncertainty, Canadians voted for more of the same. The full implications of this would likely require an entire article on it’s own, but for now, I think the fact the election is over may be seen as a comfort to some.

Markets in April, specifically stocks and crypto, had a pretty rough patch in the middle of April. With many investors experiencing losses flashing as far down as 12-20%+ in only a few short weeks, a lot of people likely had their down payment money significantly reduced. This was off the back of additional US tariff threats to virtually every country in the world, which of course, never materialized. The rebound took some time, but April closed out very near where the month opened. Most other markets are 5-10% down year to date.

The Bank of Canada: Next announcement June 4th

We also saw our first pause with the rate cuts! The April 16th Bank of Canada announcement brought no changes to the benchmark rate for the first time in the last 7 announcements. While Tiff Macklem subsequently stated the bank seriously considered cutting rates again in April, they chose to hold off for the time being, specifically citing the need to gather more data on the potential impacts of US tariffs, as well as generally acceptable inflation and employment data. This may have stifled some buying activity, as many purchasers were expecting mortgage rates in the mid 3% range by summer, but most of the best offerings available now are in the upper 3% to lower 4% range.

With no announcement in May, buyers are going to need to wait a while before seeing if their mortgages will get any cheaper. This entire series of decisions may have taken some of the urgency out of the buyers in our market.

The Rest of the Country: How do we compare?

Winnipeg has continued to perform surprisingly well when compared to most of Canada’s other metro real estate markets. The Greater Toronto and Vancouver areas have continued their descent in terms of price and absorption, particularly when considering the condo market in both areas, and some of the more distant location from the core areas.

Cities such as Calgary, Halifax, Montreal and Edmonton are all experiencing gains similar to or in excess of what we’re seeing in Winnipeg. The price points for these markets vary, but they remain far lower than the two biggest nationwide.

Accountability Check: How are my predictions doing?

On December 27th 2024, I predicted the April 2025 Benchmark price would be $456,600. At the same time, I predicted a price of $467,200 for May 2025.

Advice for Buyers and Sellers in Today’s Market

For Buyers:

With the market showing its first signs of slowing down, now is the time to act! The best houses will likely continue to sell for multiple offers significantly over asking, but there will be plenty of homes listed at or near fair value which can be bought for almost exactly asking price. DM me if you’d like to discuss your personal situation, but here’s some tips for winning as a buyer in this challenging market:

1.) See everything. If your have viewed every house in an area, and a listing agent happens to have an offer date with nothing to present their, you better believe your realtor is going to get a phone call from that listing agent looking for an offer. This can only happen if you actually go to see the houses!

2.) Don’t be afraid to write. With more houses coming to market, there will likely be less concentration of interested buyers on a singular property going into the late Spring and Summer. If you like the house, write the offer. It will probably be less competitive than February, March and April.

3.) Shop hard on Wednesday. With most offer nights occurring on Monday or Tuesday evening, waiting to see which homes missed their offer nights, and then acting quickly can be a fantastic way to get into something with little to no competition.

For Sellers:

This is still one of the best markets to sell into in a long time, but things are changing quickly, and the strategies you may wish to use have to be more carefully considered.

Depending on the price point and level of buyer activity for your particular product, listing at a very attractive price and collecting multiple offers is still a fantastic game plan. That being said, if you have something with a slimmer buyer pool, or simply require a higher price, listing closer to or precisely at the value you were hoping for can still be a very effective tool.

Before listing, consider the pricing strategies and outcomes of all other properties in the area over the past week. If most missed offers, or sold very close to asking price, starting super low may be risky. If all of them got absorbed on offer day for high prices, there are likely plenty of frustrated buyers in the area looking for another option.

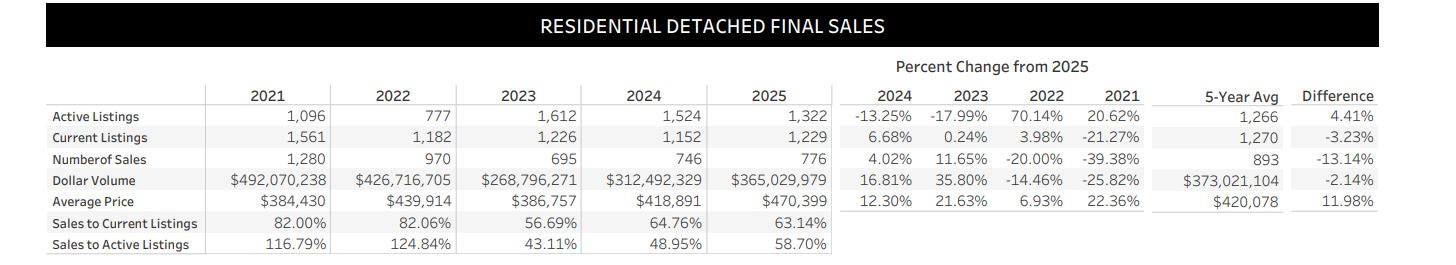

SUPPLY MARCH 2025:

March 2025:

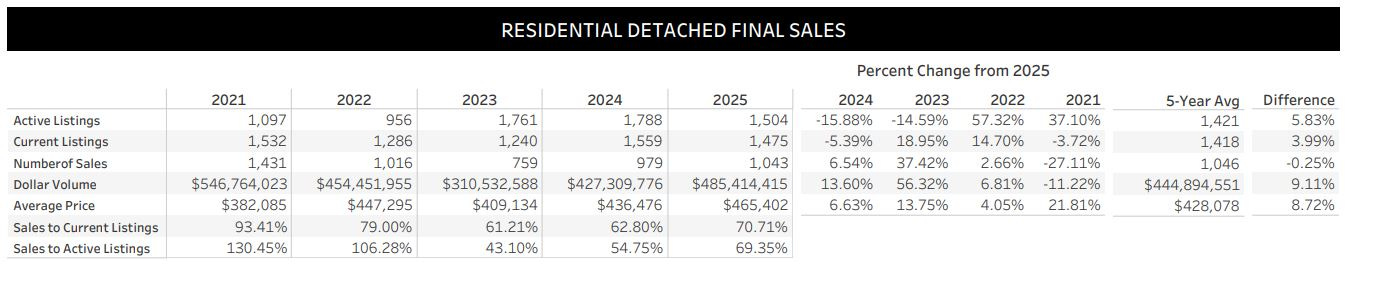

April 2025:

The supply data for April paints a picture of a very active market when compared to previous years. With metrics like number of sales, dollar volume overall, and both supply statistics skewing more seller favored than the last two Aprils, in a vacuum, this month appears to be excellent.

The month-over-month data shows some small signs of concern, but I’m not raising the alarm just yet. The supply of current listings just went up a lot — not an abnormal amount, but more than we’ve seen in prior years. The decrease in average sale price is also atypical of this time of year. The ~$465k average is still modestly higher than the benchmark price, and I am still anticipating price gains next month.

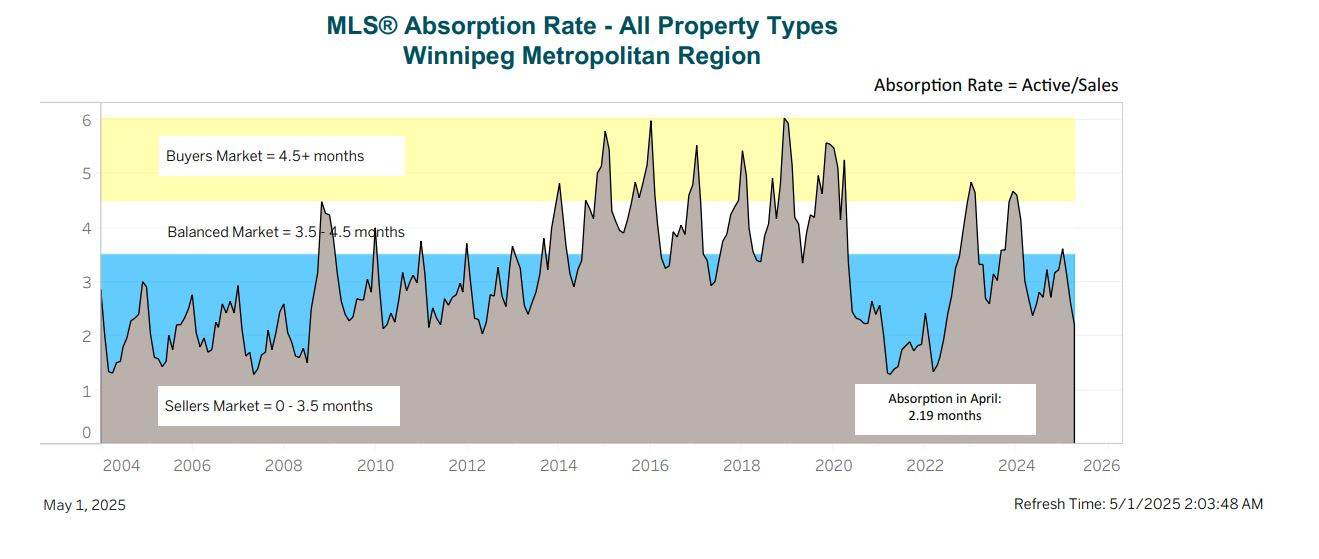

Absorption Data:

The dive into the sellers market continues! With April bringing a 2.19 month citywide absorption rate, all property types across Winnipeg are selling, and generally, selling quickly. Note, this is the most seller favored citywide absorption we’ve seen since 2022.

I continue to expect this chart to move further into seller favored territory for the coming months.

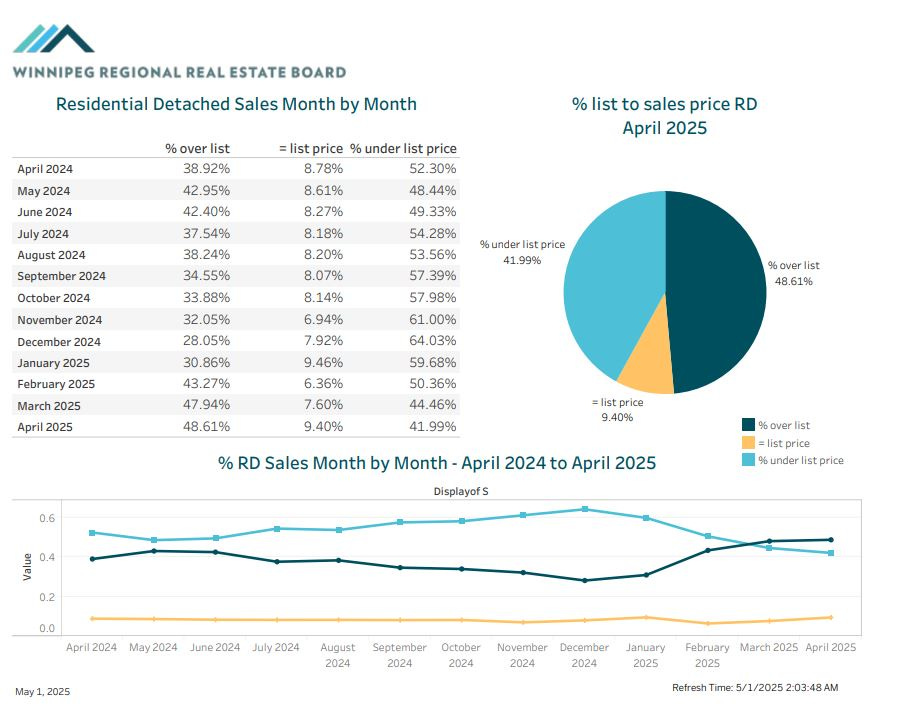

BIDDING WARS - OVER OR UNDER

With just over 58% of Winnipeg homes selling at or above asking price, it’s clear the market is still taking kindly to offer date strategies — something typical for the time of year.

Possibly more interestingly, the overall number of houses selling for precisely asking price is just about at the highest level it’s been in the last year. To me, this is a signal that we are likely returning to a market where agents and buyers alike understand pricing, and there is less of a mismatch.

Continue to expect bidding wars and low list prices in May, but anticipate some properties missing offer dates altogether, or selling bang-on for asking price.

Author’s Note: Pricing strategy is highly personal and situational. Before making any pricing decisions—whether buying or selling—reach out for a free consultation:

📞 204-955-0173

📧 keenanbrownrealtor@gmail.com

📱 @keenanb_ on Instagram

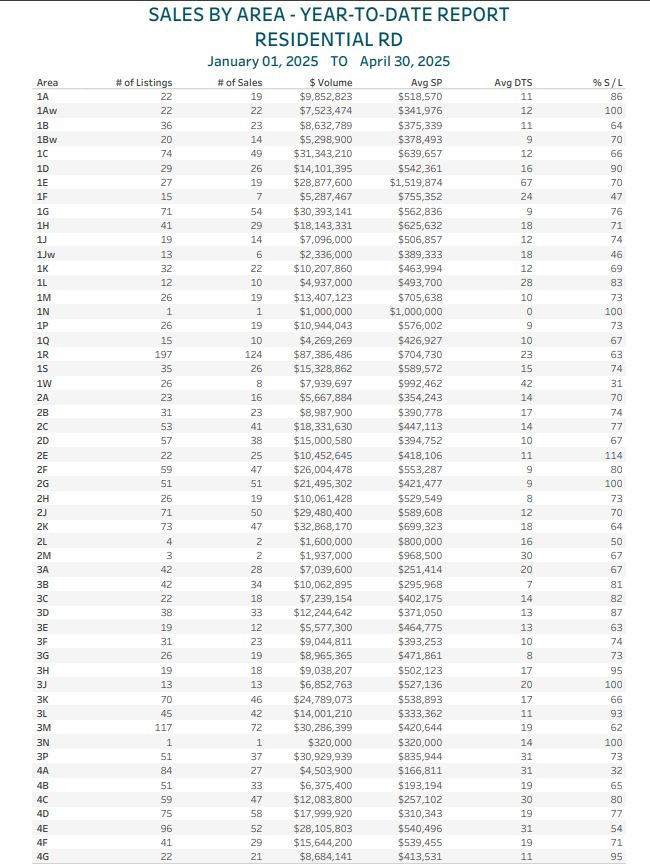

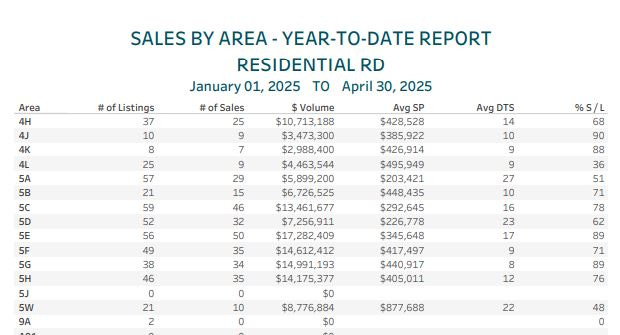

SALES BY AREA REPORT

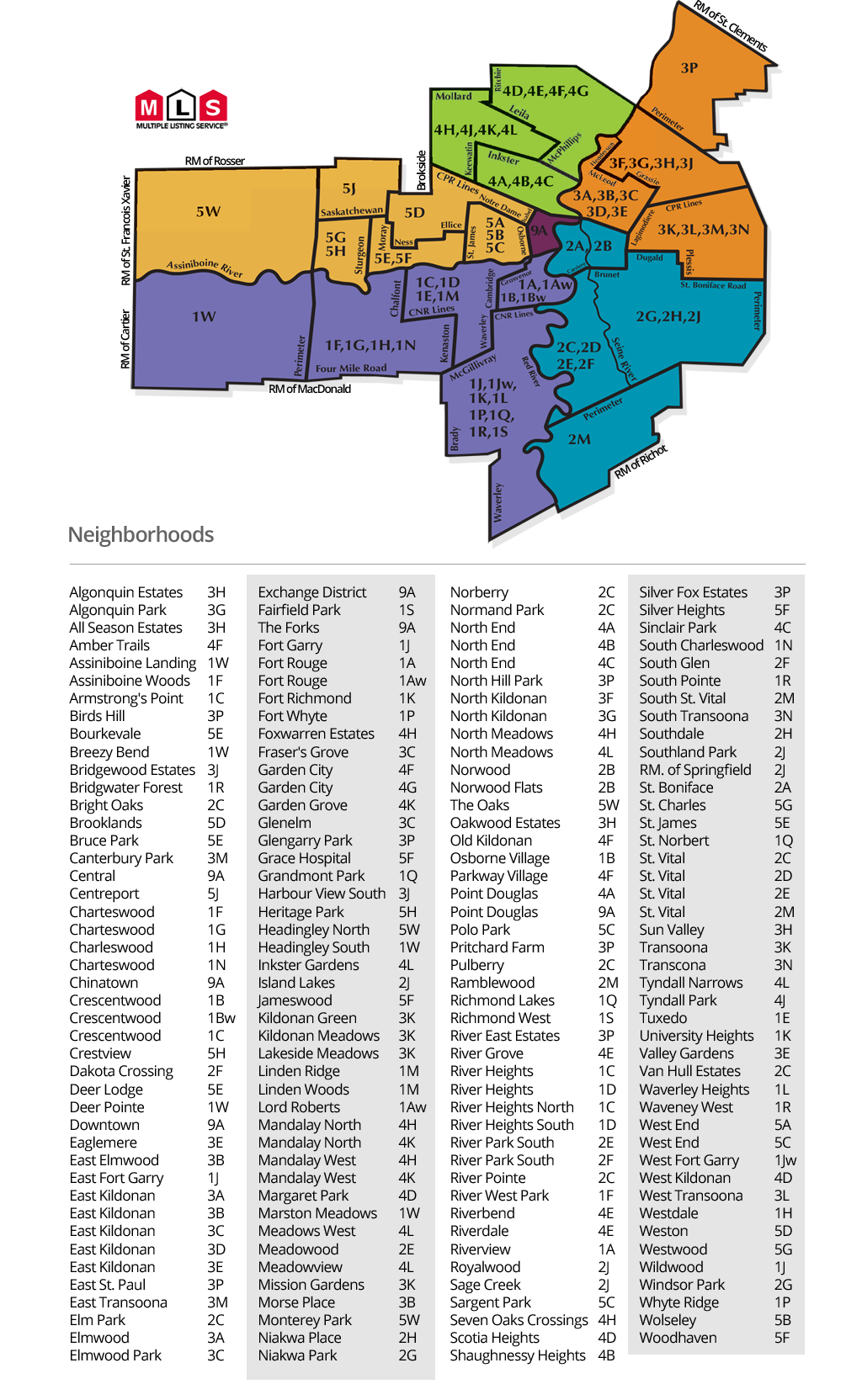

Guide on MLS area codes:

ANALYSIS

Here’s some of the hottest neighborhoods so far this year. Due to popular request, only areas with 90%+ absorption will be listed until further notice.

1Aw - Lord Roberts - 100%

1D - South River Heights - 90%

2E - Meadowood - 114%

2G - Windsor Park - 100%

3H - All Seasons - 95%

3J - Harbor View - 100%

3L - Transcona West - 93%

4G - Garden City - 95%

4J - Tyndall Park West - 90%

Check out “Hot or Not? Winnipeg Neighborhoods” released in April for more analysis on areas specifically.

2E Meadowood, 3H All Seasons, 2G Windsor Park and 1Aw Lord Roberts are all experiencing perfect absorption for the year - pretty impressive for 120 days into the year!

Most of Winnipeg’s entry level areas are still experiencing very high levels of absorption, and higher-than-previous pricing. I’ve spoken and written a lot about the barrier to entry for Winnipeg homes never being higher, and with Winnipeg’s 10 most affordable MLS areas rarely falling far under $300,000, it’s almost becoming a requirement to have either a partner on title, a co-signer, or a very large amount of cash on hand to close. What a world we live in!

Here’s a short list of neighborhoods I’m keeping a close eye on right now:

5C - Sargent Park (78% this month)

I treat 5C as somewhat of a barometer for the rest of the city (at least the sub 500 stuff) — if 5C is hot, everywhere else is probably hot. If 5C starts to slow down, or has a bad month, it is likely it will cascade very shortly across other areas. Why? Because 5C has consistently been the “affordable little brother” area to everywhere else in the West. It’s rarely a first choice, with many preferring Wolseley, Saint James, Deer Lodge etc, but willing to consider 5C for the right price. If people are buying here in a big way, that signals to me that other areas are hot.

1M -Lindenwoods + (73% last month)

I’m mostly surprised at the very limited number of homes hitting the market in this area so far! It’s shocking to me that only 26 properties have been listed at this point in the year - usually, it’s far more! With the average price sitting quite high compared to recent history, I’m very interested in watching how buyers behave in response to a really nice listing at a high price in this end of town.

2G - Windsor Park (100% last month)

2G has been a hot area for a long time, but I don’t think I’ve ever seen it hit 100% absorption before. Given the style and age of construction here combined with the average sale price being very similar to the benchmark price, I feel like this is a great time to keep an eye on where the area goes month over month.

Takeaway:

Here are the key points from today’s market update:

The Benchmark Price fell 0.86% month over month to $448,400, a rare Spring month with a pricing decrease, but still significantly higher than the previous all-time high.

More supply has arrived, but absorption remains strong. Many MLS areas are experiencing 90%+, or even 100% absorption so far this year.

Bidding wars are still the norm! Over 58% of detached homes sold at or above asking price in April 2025, although over 9% sold for exactly asking price.

For deeper insights, read “Hot or Not - Winnipeg Neighborhoods” and 2025 Predictions articles — can be found right here on Substack

Need advice? Let’s chat!

📞 204-955-0173

📧 keenanbrownrealtor@gmail.com

📱 @keenanb_ on Instagram

As always, if you find these updates helpful, please subscribe—it’s 100% free and always will be!