Winnipeg Home Price Index Update - JUNE 2025: Data From MAY 2025

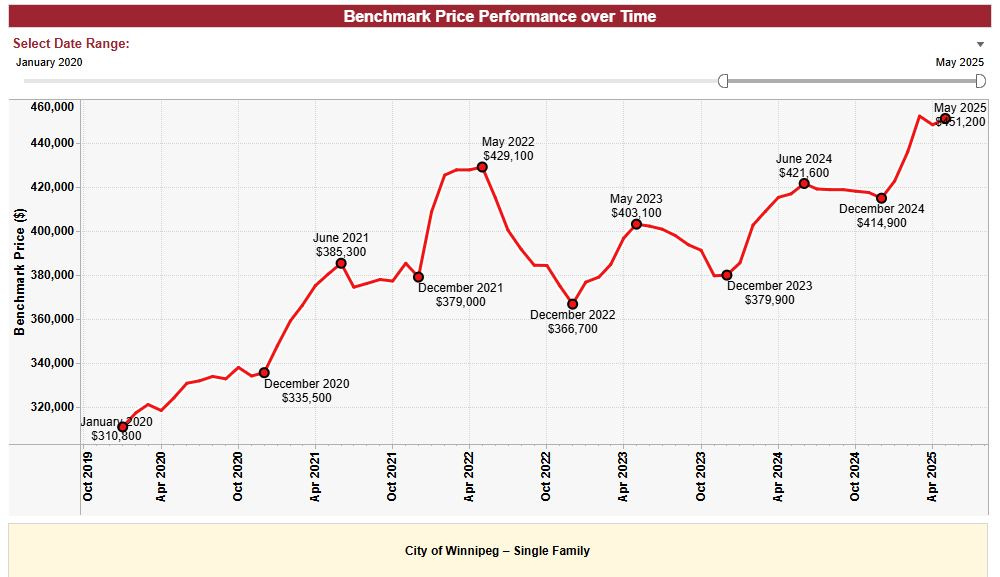

By percent, Winnipeg real estate has officially out-performed Toronto real estate since Jan 2005

JUNE 2025 HPI Update

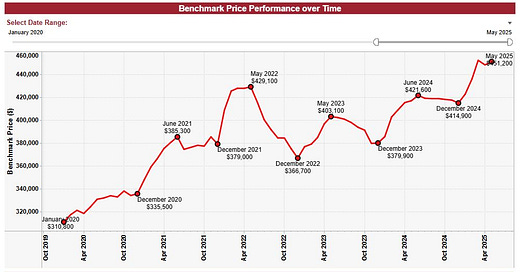

MAY 2025 Winnipeg Benchmark Price: $451,200 (down from $448,400 in April)

Year to date: +8.75% (was 8.07% last month)

Month over month: +0.62% (was-0.86% last month)

From 2024 High: +6.74%

From Former All-time High (May 2022): +5.15%

Looks like the April dip was short lived! May brought a ton of new supply to the market, but a commensurately high volume of sales. Winnipeg was also bestowed the honor of officially passing the GTA in terms of the composite HPI, meaning by percent, Winnipeg property owners have faired better than GTA owners from Jan 2005 to current, but more relevantly, also Jan 2020 to current! Apparently, slow and steady does win the race.

With many of Canada’s biggest metro areas experiencing stagnating sales and mounting losses, and uncertainty about the future of interest rates, many market participants are beginning to wonder just how much wind is left in the Winnipeg real estate market’s sails, and if the gains are sustainable. Let’s break down what happened in May, why it happened, and what’s next for our lovely city!

Broader Context: What happened in May?

Compared to the rest of 2025, May was a pleasantly calm month in terms of big economic news and crazy political developments! Tariff drama was (finally) much more of a footnote than a major focal point, the dust has appeared to settle after our federal election, and in markets broadly, most asset classes experienced consistent gains.

That being said, May was not entirely cupcakes and rainbows. Unfortunately, one of the biggest financial news items of May has been the significant rise in credit delinquency in both Canada and the United States, and along with some negative jobs GDP results, poor jobs reports, and concerning inflation figures, many macroeconomic experts are indicating that a recession is beginning to look more likely than expected in the near term.

While most Winnipeggers wouldn’t have noticed this without turning on the news or looking at Twitter/X, it has been a slight cause of concern for a small number of informed market participants, and has resulted in many buyers and sellers asking broadly “what’s next?”

The Bank of Canada: Next announcement June 4th (and July 30th after that!)

At the time of writing, we’re less than 48 hours away from the Bank of Canada’s June 4th policy announcement. I’ll be releasing a follow-up shortly after the decision drops, so please stay tuned!

Despite growing alarm bells in the broader economy, rising delinquency rates, softening job numbers, and an increasingly loud chorus of recession warning, the BoC is widely expected to hold rates steady this week. To the casual observer, that might seem counterintuitive. Why not cut now, especially with so many indicators suggesting economic softening?

In my opinion, it comes down to real estate.

The BoC isn’t just watching inflation or GDP, it’s also carefully monitoring Canada’s housing markets. While major metros like Toronto and Vancouver are facing affordability crises and weakening sales, many of Canada’s small- and mid-sized markets (Winnipeg included) are still running hot, possibly too hot for their own good. Cutting rates too soon could throw gasoline on a fire that’s already well underway in those regions, especially in the late Spring/early Summer.

In my purely speculative opinion, I expect the BoC to hold rates on June 4th, then move toward gradual easing in the back half of the year. My base case is that we’ll see rate cuts in at least 2 (and more likely 3) of the next 4 policy announcements in 2025. That would strike a measured balance, where they’d avoid overheating in stable markets while still offering later-cycle support to struggling urban centres and capital-intensive businesses impacted across the country.

Of course, I could be wrong! It wouldn’t be the first time they surprise me with a rate cut. Either way, I’ll be watching closely and will keep you updated.

The Rest of the Country: How do we compare?

The chart above compares the Home Price Index (HPI) for Winnipeg alongside Calgary, the Greater Toronto Area (GTA), and the Greater Vancouver Area (GVA). For the first time in a long while, Winnipeg real estate has outperformed both Calgary and Toronto in terms of percentage growth since January 2020.

This might come as a surprise. Historically, Winnipeg has been considered one of the more “stable and boring” real estate markets in Canada. Most have considered it very safe, but never particularly exciting. But in the face of sliding detached home prices and severe instability in the condominium markets of both the GVA and GTA, Winnipeg’s slow-and-steady approach has been paying off massively for those who have held for the past few years.

Don’t pop the champagne just yet though, some real estate commentators are starting to raise concerns about potential “contagion” or spillover effects from the very problematic scenario we’re being faced with in those larger and more volatile markets. While I think it's wise to remain cautious, the actual risk to Winnipeg is not only hard to quantify, but as of the time of writing, mostly hypothetical.

Here’s where I stand on the matter: Until resale prices in Winnipeg climb to a point where it becomes significantly more appealing (from a financial perspective) to build new rather than buy existing homes, I believe our market has a limited ceiling for losses in existing construction detached real estate. That’s not to say that price declines are impossible, rather, I believe if they do occur, they are likely to be far milder (in percentage terms) than what we might see in cities where home values have become wildly detached from the raw cost of construction exclusive of land.

Accountability Check: How are my predictions doing?

On December 27th 2024, I predicted the May 2025 Benchmark price would be $467,200. At the same time, I predicted a price of $472,000 for June 2025.

Advice for Buyers and Sellers in Today’s Market

For Buyers:

With selection improving in most price ranges every week, and the traditional “Spring rush” approaching it’s final days, this is a fabulous time to get aggressive about purchasing a choice product at a value you can understand with current year comps.

For buyers, patience has been the name of the game for the entirety of 2025, and in June, it is likely that your patience will finally pay off if it has not already. With more supply and traditionally declining demand, June is a month where sellers are often caught expecting a “Spring strategy” to yield a blowout over-asking outcome, but may be shocked to find the market spread out much more than it was in the past.

Take June as an opportunity to see EVERYTHING! Submit that asking-price offer on offer day, it’s more likely than ever that you’ll be one of few and the seller will have no choice but to do business with you!

For Sellers:

With prices remaining very high, and transaction volume at extraordinarily high levels, it is undoubtable that sellers are still in a very powerful position going into June.

That being said, poor pricing strategy and lack of preparation can burn you badly at this time of year!

Sellers need to acknowledge the ACTIVE listings on the market just as much as they may wish to look at the recent sales when pricing listings in June. With significantly more competition across virtually all areas, being cognizant of what else is able to be bought by similar buyers will be crucial to your success.

Prices may remain high, but unless you’re in a white-hot area, expect showing activity to be lower in frequency, but higher in quality as buyer spread out amongst the listings they enjoy the most. Bidding wars are still likely, but pricing closer to your base-case valuation is a good hedge for safety in the late Spring market.

SUPPLY PICTURE:

April 2025:

May 2025:

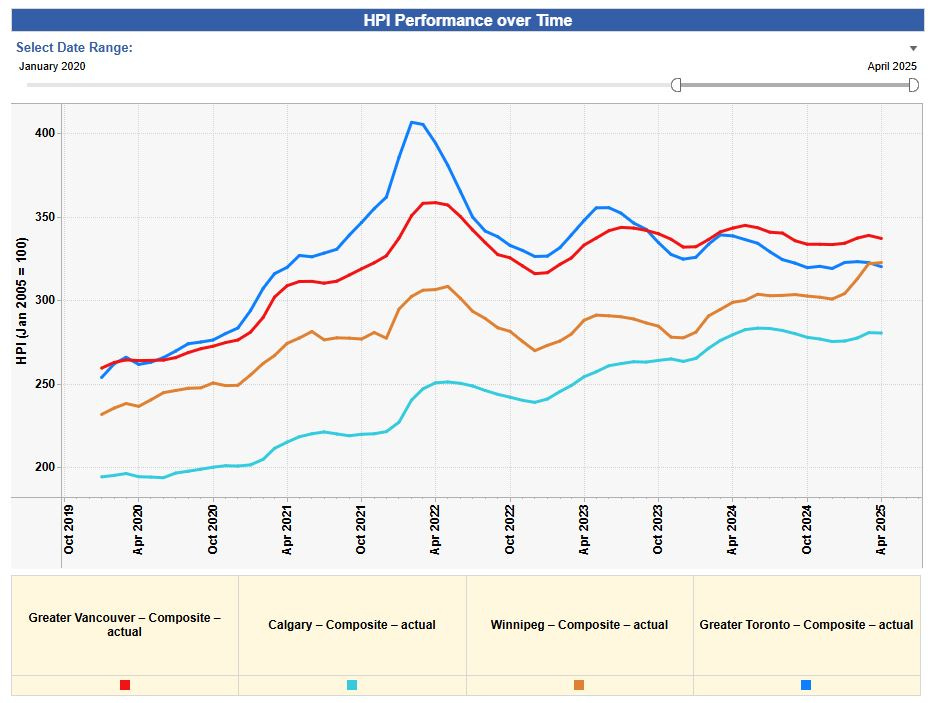

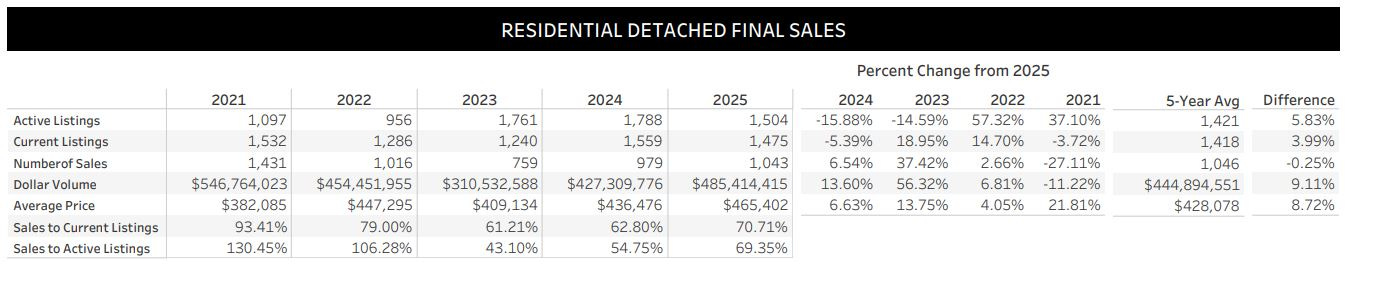

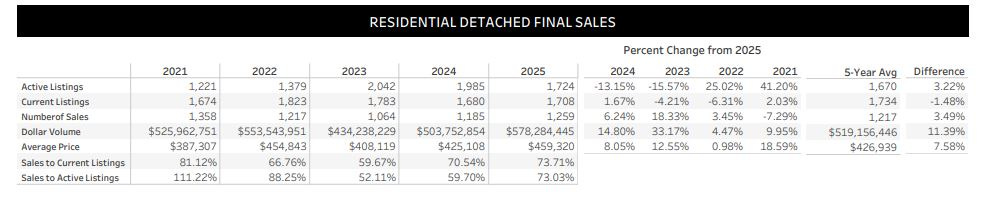

Much like April, the supply data in May continued with very high strength year over year, and commensurately strong numbers month over month. The number of sales overall is among the highest we’ve seen in years, and when combined with a somewhat low level of supply overall, that’s a recipe for a seller-favored market.

In terms of the rate of uptake, May saw about ~125 more listings hit the market than April, but it also had over 200 more sales than April. The level of active listings overall remains much lower than previous years, leaving Winnipeg’s detached market with a very solid 73% sales to both active and current listings ratio, up from 69/70% last month.

Average sale price dropped from ~$465k down to $459k, which isn’t a massive move, but my prediction of a 472k benchmark by Summer 2025 is starting to look like a target we won’t reach this year.

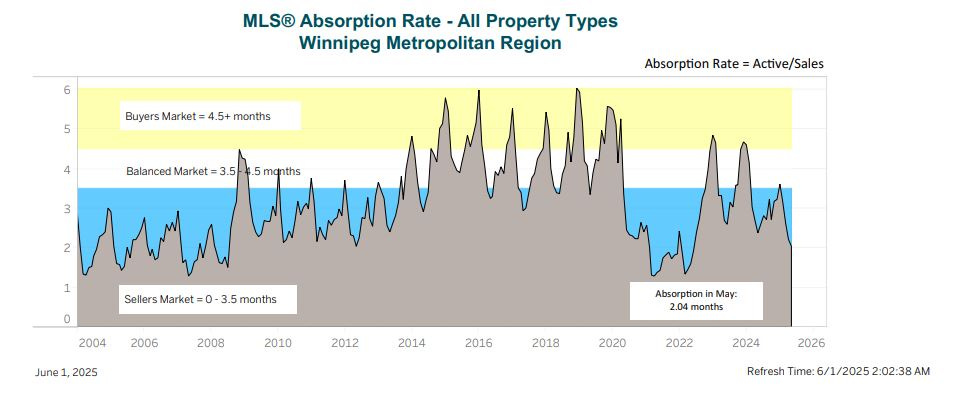

Absorption Data:

The citywide absorption remains heavily seller-favored, and will likely continue to be seller favored for several months. Seasonally, we typically see this chart begin to reverse sometime between June and August, so keep your eyes peeled for that soon!

BIDDING WARS - OVER OR UNDER

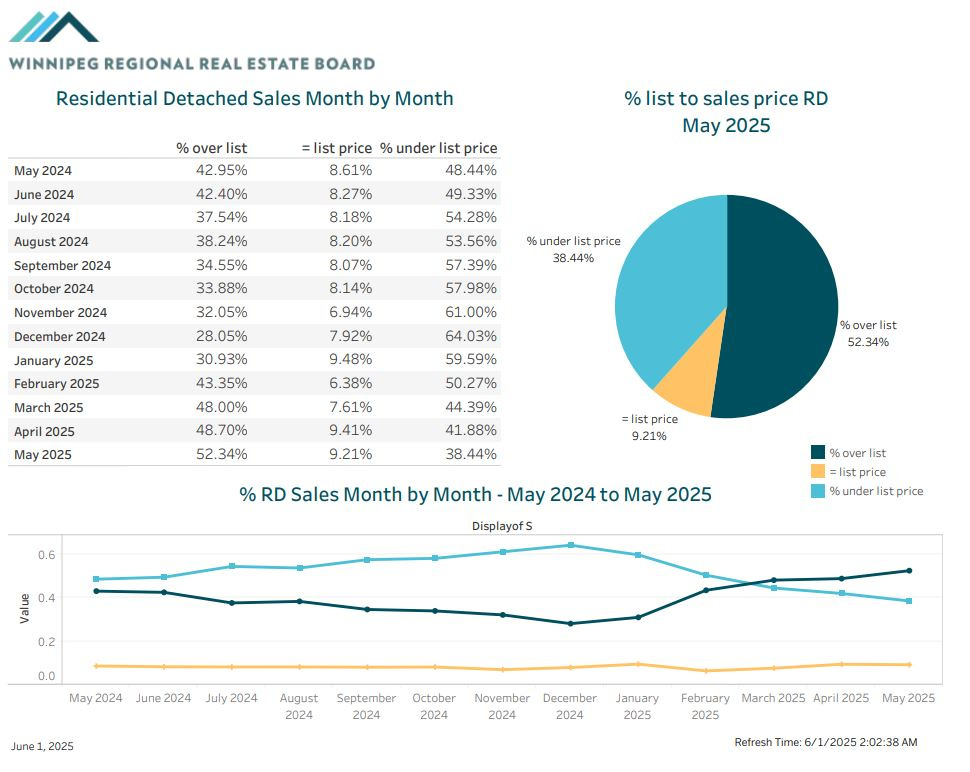

A massive 61% of Winnipeg homes sold at or above asking price this May, which is among the highest rates we’ve seen in a very long time. This is likely in part due to the very tight supply situation and remarkably consistent buyer demand.

May’s data also showed 9.21% of detached homes selling for precisely asking price, which is certainly a signal that listing strategy has continued to skew more balanced, and that buyers and sellers are continuing to remain on the same page about the value of property.

Continue to expect bidding wars and low list prices in June, but anticipate more properties missing offer dates altogether, or selling bang-on for asking price than we saw in May.

Author’s Note: Pricing strategy is highly personal and situational. Before making any pricing decisions—whether buying or selling—reach out for a free consultation:

📞 204-955-0173

📧 keenanbrownrealtor@gmail.com

📱 @keenanb_ on Instagram

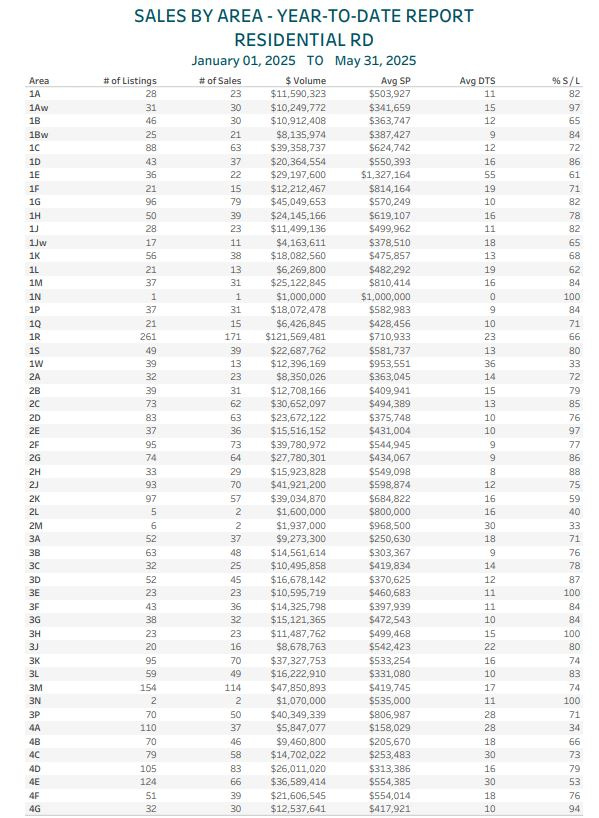

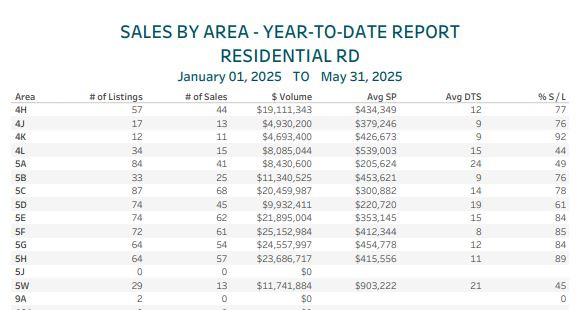

SALES BY AREA REPORT

Guide on MLS area codes:

ANALYSIS

Here’s some of the hottest neighborhoods so far this year. Due to popular request, only areas with 90%+ absorption will be listed until further notice.

1Aw - Lord Roberts - 97%

2E - Meadowood - 97%

3E - East Kildonan - 100%

3H - All Seasons - 100%

4G - Garden City - 94%

4k - Tyndall Park East - 92%

Check out “Hot or Not? Winnipeg Neighborhoods” released in April for more analysis on areas specifically.

Here’s a short list of neighborhoods I’m keeping a close eye on right now:

5C - Sargent Park (78% this month)

I ALWAYS watch 5C, as it is the area in which I conduct the majority of my business! With prices climbing virtually everywhere citywide, 5C continues to offer attractive, conventional housing at affordable price. With absorption remaining healthy, and listing volume continuing to be high, I am feeling confident about the health of the area and the lower portion of Winnipeg’s home buying market in general.

1R - Bridgwater + (66% last month)

With only limited number of new detached homes hitting the market compared to previous years, 1R has seen very high pricing and absorption in recent months. With listings in the area on the immediate horizon, I’ve been carefully watching the outcomes of most properties around the average sale price and have been pleasantly surprised by the ease of which they’ve sold. Keep an eye out for 1R, this area could go off in a big way in the coming years.

3K - Devonshire Park (74% last month)

3K is a very diverse MLS area, featuring brand new construction, wartime housing, post-recession development, and 70s/80s starter homes all within minutes of each other! With listings coming up on the near horizon in this area, and at least one buyer aiming to pick up a 3K new build, I have spent a lot of time watching the dynamics at play here, and have been analyzing pricing closely.

Takeaway:

Here are the key points from today’s market update:

The Benchmark Price rose 0.62% month over month to $451,200, a reversal of the small loss last month, leaving Winnipeg real estate a sliver shy of the all-time high.

Supply is higher than prior months, but still low compared to the past! It’s hard to feel the new homes coming onto the market when they’re getting bought up so quickly.

Bidding wars are still the name of the game. Over 61% of detached homes sold at or above asking price in May 2025, one of the highest levels we’ve seen since the peak of the crazy 2022 market.

For deeper insights, read “Hot or Not - Winnipeg Neighborhoods” and 2025 Predictions articles — can be found right here on Substack

Need advice? Let’s chat!

📞 204-955-0173

📧 keenanbrownrealtor@gmail.com

📱 @keenanb_ on Instagram

winnipegmarketwatch.substack.com

As always, if you find these updates helpful, please subscribe—it’s 100% free and always will be!