Winnipeg Home Price Index Update - Data From April 2024

Only four months ever have been higher than now, but how long can the party last?

Welcome back to another market update! April is over and once again we’ve seen some massive developments in our real estate market. Prices continue to rise, supply continues to hold, transaction volume is up, and bidding wars are back in full swing.

A podcast version of this update will be available on Sunday May 5th. The majority of the details and accompanying visuals will be found in the written article below for your reference. You can have these updates, other articles and podcasts emailed to you as they are released by subscribing using the link at the bottom (for free!).

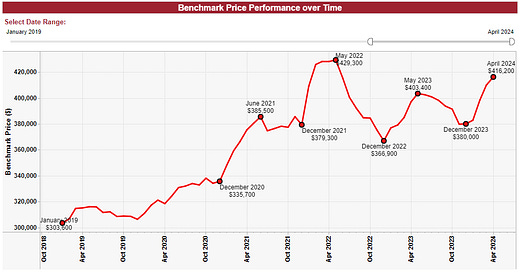

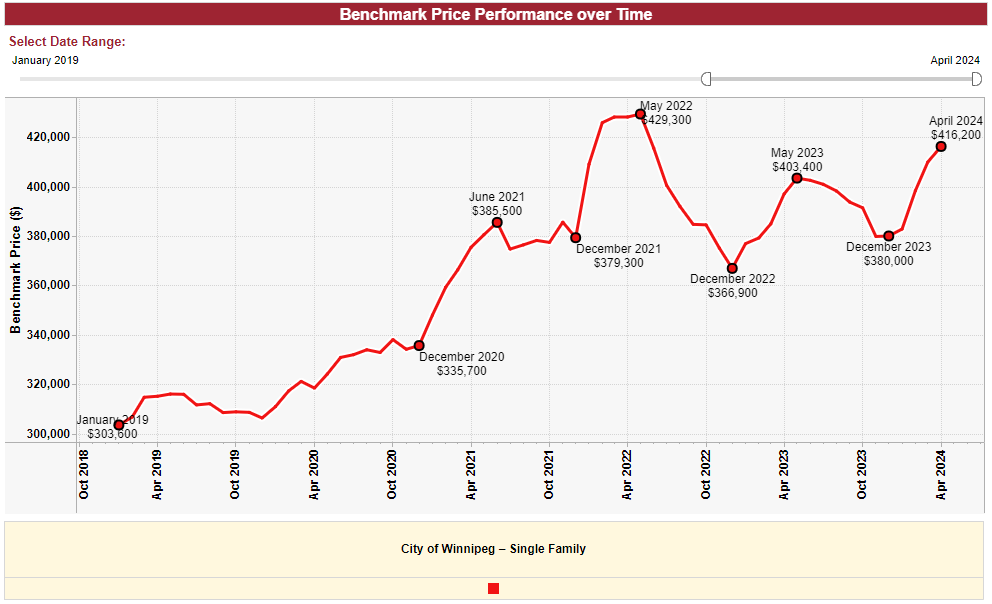

April 2024 HPI Update

April Winnipeg Benchmark Price: $416,200 (up from $409,900 in March))

Year to date: +9.53% (Was +7.87% last month)

Month over month: +1.54% (Was +2.91% last month)

From All-time High: -3.05% (Gain of +3.15% required to return to ATH from here)

Another strong month in the books! April 2024 saw another stark increase in the benchmark price coupled with very strong seller favored supply metrics and overall solid absorption. As of now, only 4 months in the history of Winnipeg real estate have ever seen a benchmark price beyond what the data is showing us today (February, March, April and May 2022 were higher). The rate of change in prices fell to only +1.54% month-over-month, which is only about half of the gain seen in the March data and less than the gain seen in the February data. With pricing being up 9.53% in only 120 days, it’s clear the Spring market is in full swing, but the question on everyone’s mind still lingers - how long will it last?

It remains my opinion that minor interest rate changes are not particularly relevant to our local market, which is still one of the most affordable markets in all of North America, but I do think the perceived direction and schedule of potential rate changes can impact both buyer and seller psychology and is worth considering when analyzing market data. The interest rate decisions scheduled for June will likely pave the way for what to expect for the rest of the year. Most signs are pointing to a “no changes” announcement as of the time of writing, which would likely coincide with the natural conclusion of our strong Spring market from a historic perspective.

With this in mind, the message to me is very clear: Sellers on the fence should list sooner rather than later and take advantage of the massive gains we’ve just experienced. Buyers looking for discounts, or buyers who wish to shop at a more leisurely pace may be able to hold off on purchasing until mid Summer and Fall, although their selection may be limited by that point in time.

SUPPLY April 2024

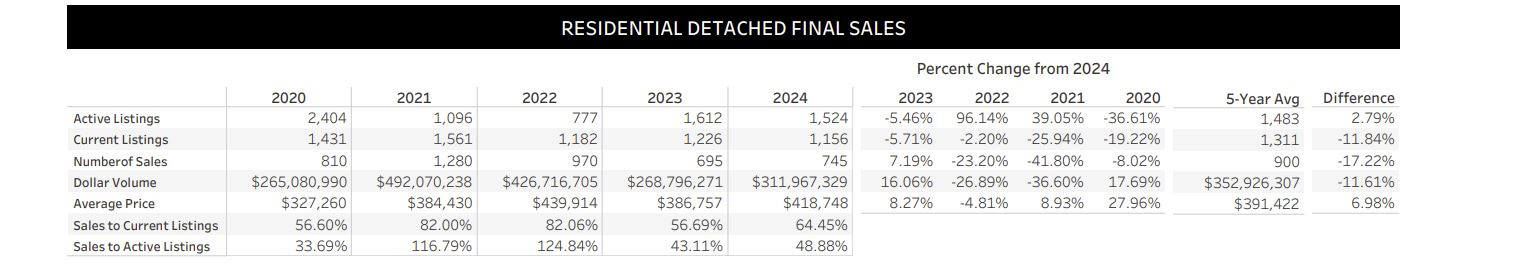

March 2024 data:

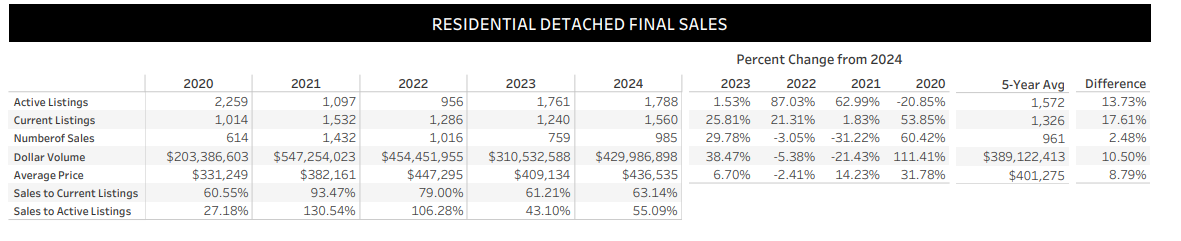

April 2024 data:

The main takeaway from the April supply data is the strength compared to 2023. The total number of active listings was very similar, at 1788 instead of 1761, but in 2024 FAR more listings are current (sub 30 days on market). Additionally, 30% more listings sold in April 2024 than April 2023, which is a very significant volume gap. This is a huge sign of strength and robustness throughout the buyer pool. Last, the average sale price remains incredibly high at $436,535, which suggests to me we still likely have at least another month of price gains on the horizon, as this average is ~5% higher than the current benchmark price.

It should be noted, the total number of sales is very near the level of April 2022, which was very near the time of our last all time high for the detached benchmark price.

Absorption Data:

As expected, we took yet another jump deeper into seller favored territory this April. With supply the way it was and pricing continuing to accelerate, this should come as a surprise to absolutely no one. This trend is widely expected to continue for at least another month or two before moving back upwards towards a neutral market in the Fall season.

BIDDING WARS - OVER OR UNDER

It’s official, this is the most common bidding wars have been in the last 2 years! As of April 2024, roughly 48% of detached homes sold at or above asking price. The current paradigm for pricing strategy appears to be list closer to the bottom of the value range and let the market float the value to where it should be. Obviously this shouldn’t always be the tactic, especially at the higher price points, but it will be interesting to see how the coming months impact list price decisions and watch those changes get reflected in the data. For now, it looks like the bidding war game is a winning one, and it seems many sellers are enjoying reviewing asking price or higher offers on their offer night for now.

SALES BY AREA REPORT

Guide on MLS area codes:

I’d classify absorption numbers as follows (From a YTD perspective):

85%+ = Extremely hot. Almost everything is selling on an offer day, not much is on the market.

70%-85% = Hot. most listings are selling, bidding wars happen, listings don’t sit long.

50-70% = Balanced. The best listings and best priced listings will sell without trouble, but greedy sellers and buyers may be in for disappointment.

35-50% = Cold. Most homes aren’t selling easily. There is likely a lot of supply on the market and most listings are stacking days on market with little attention.

< 35% = Extremely cold. The area is saturated with listings, very few properties sell quickly, very few buyers shopping in the area.

ANALYSIS

Here’s some of the hottest neighborhoods by absorption in 2024 (about 85% or higher):

3E - Kildonan Crossing (mid NK) - 105%

3C - Glenelm/Frasers Grove - 100%

1D - South River Heights -96%

1J - Fort Gary - 93%

1Bw - Crescentwood - 88%

3J -Harborview South - 88%

3P - East Saint Paul - 86%

5G - Westwood - 86%

1S - Richmond West - 85%

3H - Springfield/All Seasons - 85%

5F - Silver Heights/Woodhaven - 85%

Some VERY interesting area trends in this data dump!

First, it needs to be mentioned that any area starting with a 3 is generally quite popular right now. We’re over 120 days into the year and every single home listed in 3E has sold from Jan 1 on, AND there isn’t a single active listing on the market in the entire area! Similar story for 3C, which had 0 actives three days before publication, and now features two attractive bungalows for great prices with offer dates. I think the spillover from the huge price gains in 3G and 3F last year have found buyers moving into 3C,D,E and other nearby areas as they can’t justify bidding up the best parts of North Kildonan any further at this time. Expect to see these more affordable areas continue to win in the near term.

In a surprising turn of events, on the other side of the river, the areas beginning with a “4” seem to be having a hard time right now. Many of you may recall 4J and 4K were the kings of the hotlist last year, but both areas have struggled to crack 80% absorption this year. The story is similar for most of the Maples and Garden city areas, as pricing has likely gotten to the point where it’s tough to convince a buyer to go any further in the face of other options.

While none of the “2” areas made this list this time, almost every “2” area sat in the 70s or 80s this month, which is reasonably strong and actually surprisingly healthy for a set of areas severely lacking supply for many months at the end of last year. I think these neighborhoods are in a great spot, and should be excellent for both buyers and sellers to feel like they’re getting a fair shake.

Here’s a short list of neighborhoods I’m keeping a close eye on right now:

1G and 1H - Charleswood and Ridgewood West - 73% and 72% (was 81% and 72%)

I listed two properties in these areas last month, and I’m going to be listing two more in May! The areas are both progressing beautifully in terms of price. 1H is currently at an all-time high based on the benchmark price, and 1G will probably crack the all-time high next month. Supply is consistently very tight in both areas, and good products have been breaking records all year.

5C - Sargent Park and the West End (82% this month)

5C has been on somewhat of a quiet rampage this year, with consistently solid absorption and really solid price gains in-line with the overall market. It seems like buyers are finding the low prices to be quite appealing and are starting to move into the area with force. I’m eager to see how this development continues throughout the next few months.

3C and 3E - Glenelm/Frasers Grove, and mid Kildonan - (100 and 105%)

I’m watching this because I barely believe what I’m seeing. These areas areas are so hot it’s almost shocking. They’re both less than 1% off from their respective all time highs in terms of pricing, and their absorption has been sky high for 4 straight months. With this trend continuing, I wouldn’t be surprised to see both of them set new benchmark records next month.

Takeaway:

Here are the key points from today’s market update:

The HPI index rose 1.54% month over month, up to $416,200 and down about 3.05% from the all-time high.

Supply metrics continue to trend strongly in a seller favored direction, with many neighborhoods experiencing extremely low listing activity. The market has pushed deeper into seller favored territory and appears to be on track to move further.

Bidding war prevalence has increase once again! roughly 48%+ of detached homes in Winnipeg sold at or above asking price in April 2024, which is the most since June 2022.

Only 4 months in history have ever had a benchmark price higher than April 2024 - February, March, April and May of 2022.

Stay tuned for the next article, leave a comment if you found this helpful, and feel free to reach out if you would like to discuss anything in further detail.